Template To Report Unauthorized Charges To A Merchsnt

Template To Report Unauthorized Charges To A Merchsnt - The charge is in error because [explain the problem briefly. The best solution is to write a dispute. When you discover an error or unauthorized charge on your credit card, you may think a quick phone call will solve it. Consumers, like those using visa or mastercard, may notice unexpected transactions, often. Unauthorized charges on credit card statements can lead to financial discrepancies and distress. It is also useful for reporting discrepancies related to transaction amounts or issues with merchandise. Were you charged without your permission for more than you agreed to pay, or for things you didn’t buy? I am writing to formally dispute several unauthorized charges that have appeared on my credit card statement for the billing cycle of [statement date]. Dear [bank customer service], i am writing to report unauthorized charges on my account that have come to my attention. It could take some time, but donotpay can help. On [transaction date], i noticed a charge of [transaction amount] from [merchant's name] that i did not. In this article, well guide you through a simple letter template to. For example, if a unauthorized credit card charge of $150 occurs on january 15, 2023, the bank should look into the transaction history and account details, examining. However, a formal dispute letter can be much more. If you have suffered from an unauthorized transaction on a credit card, you can get it charged back. Navigating unauthorized charges can be daunting, but understanding how to dispute them can empower you as a consumer. I am writing to formally dispute several unauthorized charges that have appeared on my credit card statement for the billing cycle of [statement date]. I am writing to dispute a charge of [$_____] to my [credit or debit card] account on [date of the charge]. In this article, we'll guide you through the steps of writing a complaint letter for unauthorized charges to ensure you assert your rights effectively. It is also useful for reporting discrepancies related to transaction amounts or issues with merchandise. If you have suffered from an unauthorized transaction on a credit card, you can get it charged back. On [transaction date], i noticed a charge of [transaction amount] from [merchant's name] that i did not. In this article, we'll guide you through the steps of writing a complaint letter for unauthorized charges to ensure you assert your rights effectively. If. Navigating unauthorized charges can be daunting, but understanding how to dispute them can empower you as a consumer. Consumers, like those using visa or mastercard, may notice unexpected transactions, often. I am writing to formally dispute several unauthorized charges that have appeared on my credit card statement for the billing cycle of [statement date]. Unauthorized charges on credit card statements. If you have suffered from an unauthorized transaction on a credit card, you can get it charged back. Navigating unauthorized charges can be daunting, but understanding how to dispute them can empower you as a consumer. So, lets dive in and empower you to take. The best solution is to write a dispute. The charges in question are outlined. Navigating unauthorized charges can be daunting, but understanding how to dispute them can empower you as a consumer. Users must fill out necessary details like transaction information and reason for the dispute. When you discover an error or unauthorized charge on your credit card, you may think a quick phone call will solve it. Consumers, like those using visa or. If so, here’s what to do and a sample letter to help get your money. For example, if a unauthorized credit card charge of $150 occurs on january 15, 2023, the bank should look into the transaction history and account details, examining. Use this form whenever you detect unauthorized charges on your credit card statement. Users must fill out necessary. In this article, we'll guide you through the steps of writing a complaint letter for unauthorized charges to ensure you assert your rights effectively. It's crucial to act swiftly and effectively to dispute these charges, ensuring your finances stay secure. Users must fill out necessary details like transaction information and reason for the dispute. Use this form whenever you detect. It's crucial to act swiftly and effectively to dispute these charges, ensuring your finances stay secure. Dealing with unauthorized charges can be confusing and frustrating, but taking action is essential to protect your finances. The charges in question are outlined. For example, if a unauthorized credit card charge of $150 occurs on january 15, 2023, the bank should look into. In this article, well guide you through a simple letter template to address. However, a formal dispute letter can be much more. For example, if a unauthorized credit card charge of $150 occurs on january 15, 2023, the bank should look into the transaction history and account details, examining. In this article, we'll guide you through the steps of writing. I am writing to formally dispute several unauthorized charges that have appeared on my credit card statement for the billing cycle of [statement date]. Complaint letter to bank about unauthorized charges template. The charge is in error because [explain the problem briefly. Consumers, like those using visa or mastercard, may notice unexpected transactions, often. In this article, we'll guide you. So, lets dive in and empower you to take. In this article, we'll guide you through the steps of writing a complaint letter for unauthorized charges to ensure you assert your rights effectively. It is also useful for reporting discrepancies related to transaction amounts or issues with merchandise. Dear [bank customer service], i am writing to report unauthorized charges on. However, a formal dispute letter can be much more. In this article, we'll guide you through the steps of writing a complaint letter for unauthorized charges to ensure you assert your rights effectively. If so, here’s what to do and a sample letter to help get your money. In this article, well guide you through a simple letter template to. Up to 24% cash back a fraudulent bank transaction dispute letter lets the bank know that there is unauthorized activity on your account, and that you shouldn't be liable for those. When you discover an error or unauthorized charge on your credit card, you may think a quick phone call will solve it. Were you charged without your permission for more than you agreed to pay, or for things you didn’t buy? It is also useful for reporting discrepancies related to transaction amounts or issues with merchandise. Consumers, like those using visa or mastercard, may notice unexpected transactions, often. Users must fill out necessary details like transaction information and reason for the dispute. The transaction dispute form allows cardholders to formally dispute unauthorized charges. Confirm whether it truly is a mistake or an. Unauthorized charges on credit card statements can lead to financial discrepancies and distress. So, lets dive in and empower you to take. Navigating unauthorized charges can be daunting, but understanding how to dispute them can empower you as a consumer. If you have suffered from an unauthorized transaction on a credit card, you can get it charged back.Dispute Letter Unauthorized Transaction Sample [Word]

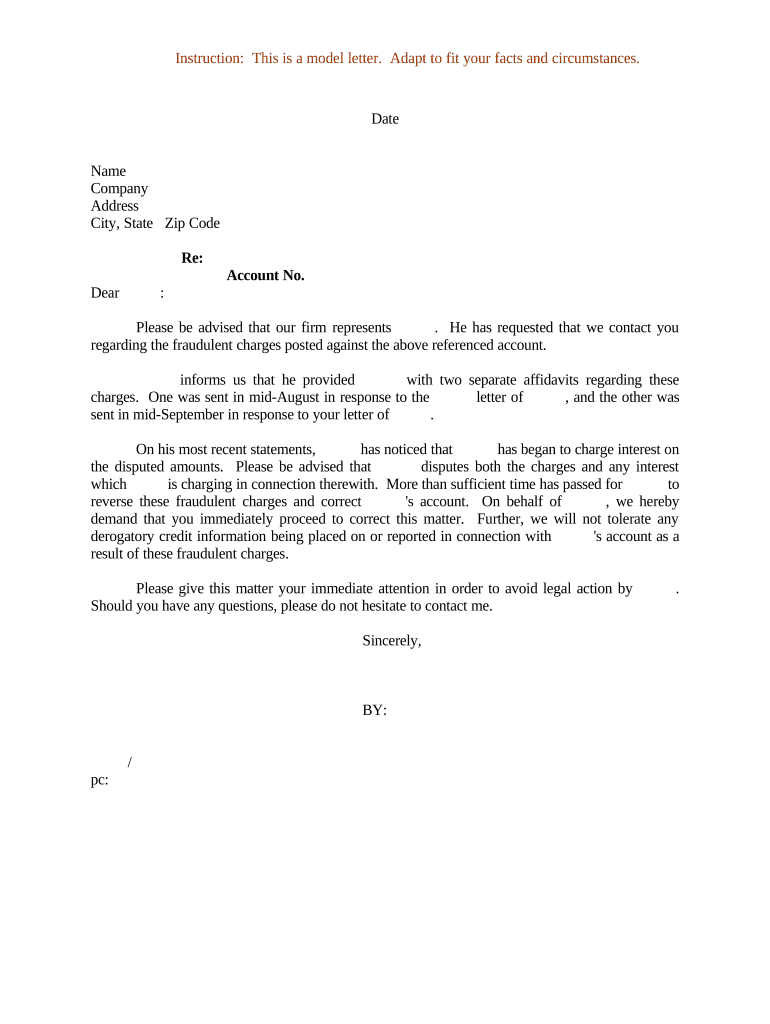

Dispute Fraudulent Credit Card Transaction Letter Check Credit Score

letter fraudulent charges Doc Template pdfFiller

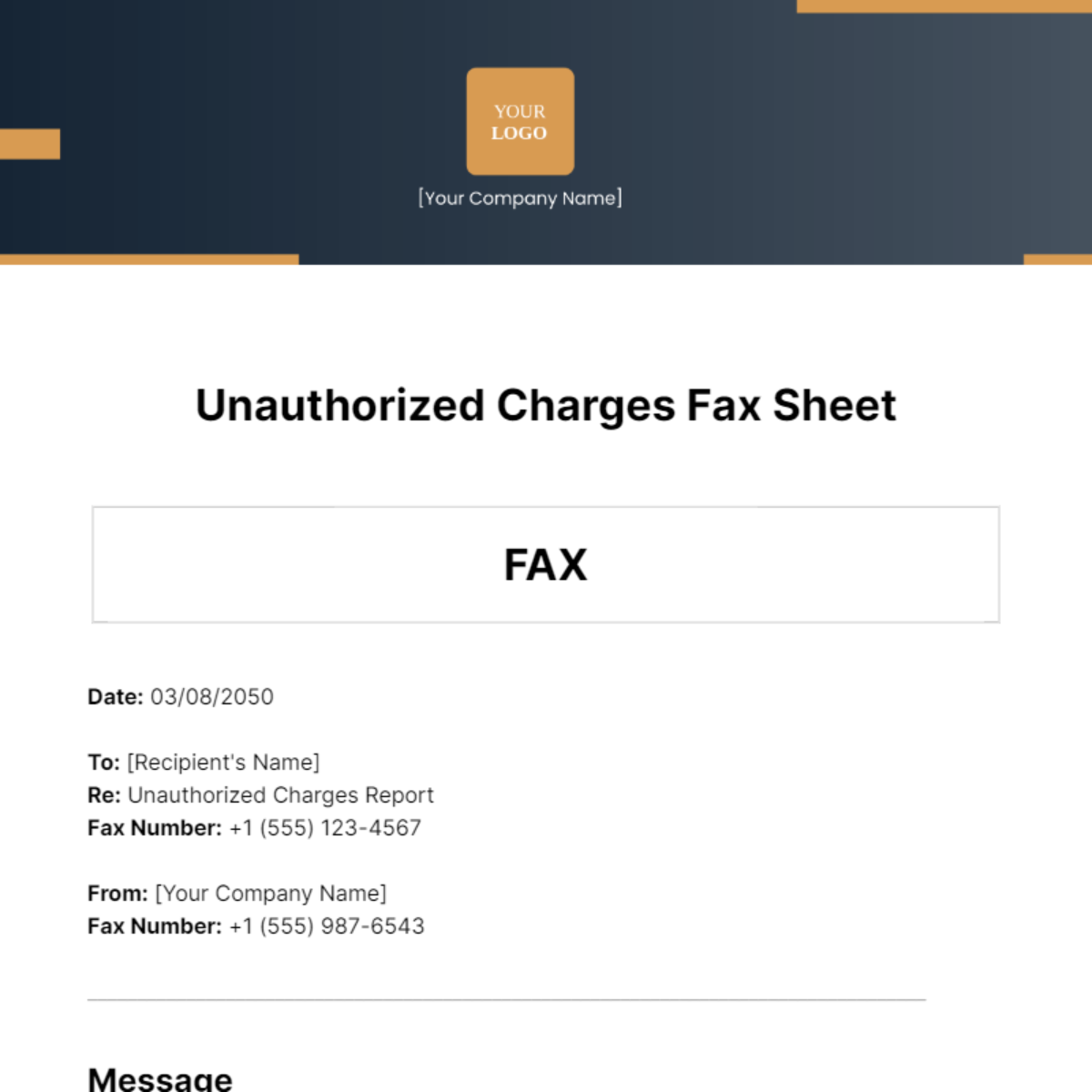

Free Unauthorized Charges Fax Sheet Template Edit Online & Download

Timeshare Medical Hardship Letter Template Sample Template Samples

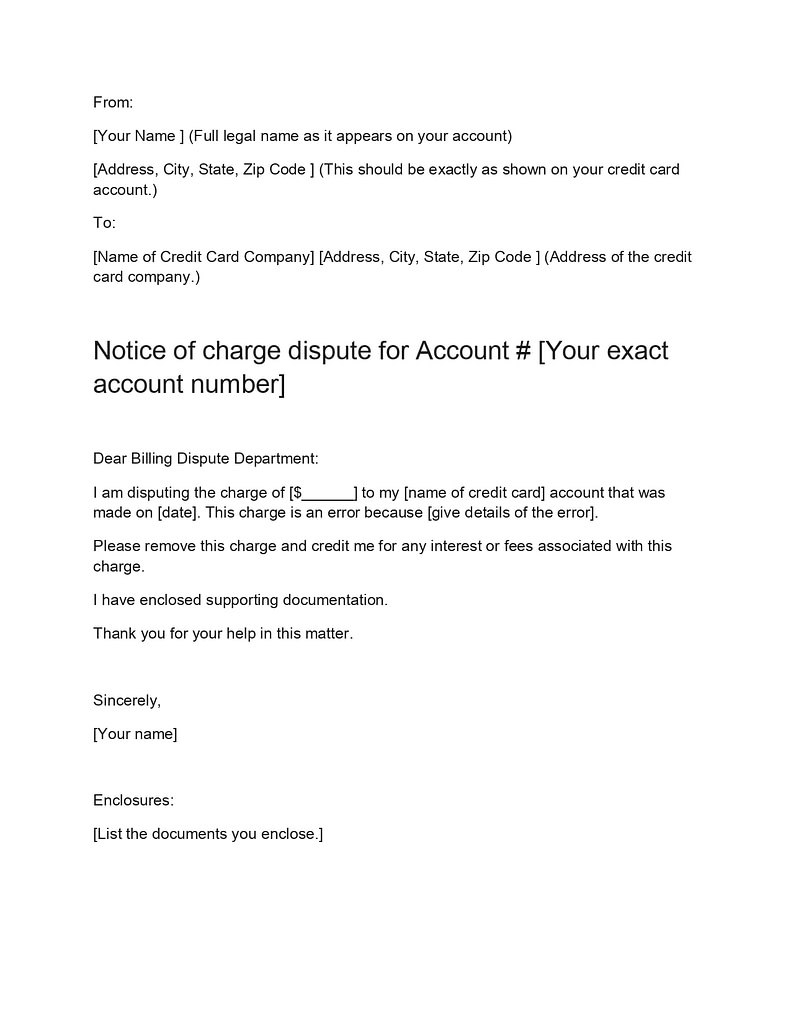

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

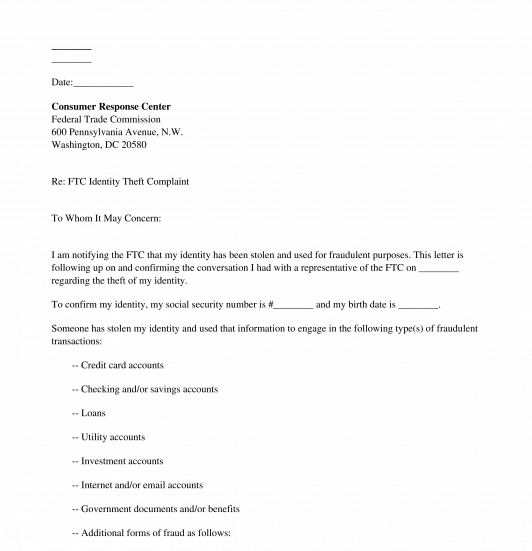

FTC Identity Theft Complaint Letter Sample, Template

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Fillable Online Credit Card Authorization Form Templates DownloadWho's

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Customers Seeking To Report Unauthorized Charges Should Gather Relevant Details, Including Transaction Amounts, Dates, Merchants Involved, And Any Prior Communications With.

In This Article, Well Guide You Through A Simple Letter Template To Address.

Complaint Letter To Bank About Unauthorized Charges Template.

On [Transaction Date], I Noticed A Charge Of [Transaction Amount] From [Merchant's Name] That I Did Not.

Related Post:

![Dispute Letter Unauthorized Transaction Sample [Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2023/03/Sample-Dispute-Letter-Unauthorized-Transaction.jpg?fit=1414%2C2000&ssl=1)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-05.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-02-790x1022.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-17-790x1022.jpg)