Qualified Income Trust Template

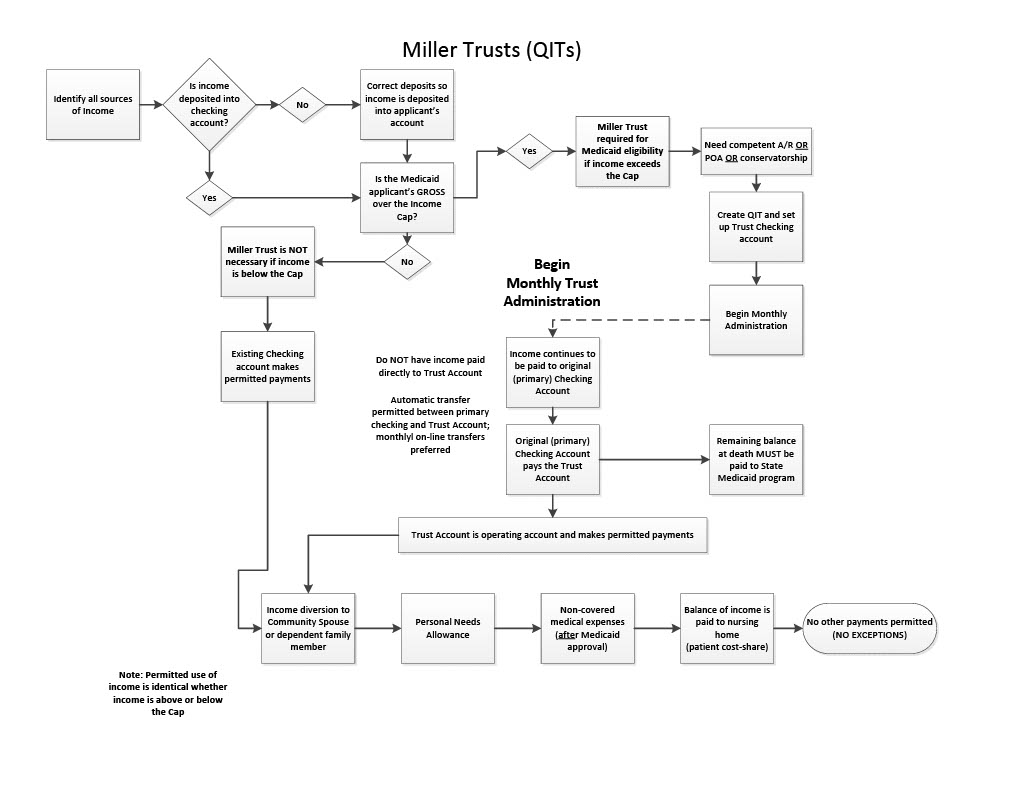

Qualified Income Trust Template - Qit frequently asked questions (faqs) qualified income trust template : A qit otherwise known as a qualified income trust or miller trust is a program that allows for medicaid eligibility specifically for seniors with a high income. This trust is a qualified income tr ust as provided by section 1917 (d)(4)(b) of the social security act as amended under obra 93, and all regulations promulgated thereunder. A miller trust (also known as a qualified income trust) is designed to own income in order for an individual to get around medicaid’s income caps. To qualify for medicaid long term care, you or your loved one must meet certain financial requirements, including an income limit. Qualified income trust, certification of trust form. But even if your monthly income is over that. The qit needs to be established and properly funded the month the applicant is otherwise eligible for medicaid benefits. A qualified income trust, or qit, is a trust that medicaid requires if a medicaid applicant has a monthly gross income of more than three times the ssi poverty limit, medicaid will deny the. What medicaid applicants need to tell a bank when establishing a qualified. The trust shall be known as the qualified income trust. first: To qualify for medicaid long term care, you or your loved one must meet certain financial requirements, including an income limit. Qit frequently asked questions (faqs) qualified income trust template : The purpose of this trust is to enable the settlor, (also referred to herein as the beneficiary), to. The property to be placed in the trust is the income received by the primary. Basic information about the use of a qualified income trust (qit) (sometimes referred to as a miller trust) to establish income eligibility for managed long term services and supports. The qualified income trust (qit) deals only with income. But even if your monthly income is over that. What medicaid applicants need to tell a bank when establishing a qualified. A qualified income trust, or qit, is a trust that medicaid requires if a medicaid applicant has a monthly gross income of more than three times the ssi poverty limit, medicaid will deny the. A qualified income trust, or qit, is a trust that medicaid requires if a medicaid applicant has a monthly gross income of more than three times the ssi poverty limit, medicaid will deny the. A qit otherwise known as a qualified income trust or miller trust is a program that allows for medicaid eligibility specifically for seniors with a high. Not everyone will benefit from a qualified. Qualified income trust, certification of trust form. The qualified income trust (qit) deals only with income. Miller trusts, also called qualified income trusts, provide a way for nursing home medicaid and medicaid waiver applicants who have income over medicaid’s limit to become. A qualified income trust, or qit, is a trust that medicaid. This trust is a qualified income tr ust as provided by section 1917 (d)(4)(b) of the social security act as amended under obra 93, and all regulations promulgated thereunder. The property to be placed in the trust is the income received by the primary. A qit otherwise known as a qualified income trust or miller trust is a program that. The property to be placed in the trust is the income received by the primary. Not everyone will benefit from a qualified. The trust makes it possible for that. The purpose of this trust is to enable the settlor, (also referred to herein as the beneficiary), to. Basic information about the use of a qualified income trust (qit) (sometimes referred. Qit frequently asked questions (faqs) qualified income trust template : Not everyone will benefit from a qualified. This trust is a qualified income tr ust as provided by section 1917 (d)(4)(b) of the social security act as amended under obra 93, and all regulations promulgated thereunder. Miller trusts, also called qualified income trusts, provide a way for nursing home medicaid. If you have income that exceeds the. A miller trust (also known as a qualified income trust) is designed to own income in order for an individual to get around medicaid’s income caps. A qualified income trust, or qit, is a trust that medicaid requires if a medicaid applicant has a monthly gross income of more than three times the. The trust shall be known as the qualified income trust. first: The proper use of a qit allows a person to legally divert income into a trust, after which the income is not counted to determine medicaid eligibility for institutional or home and. A miller trust (also known as a qualified income trust) is designed to own income in order. A qit otherwise known as a qualified income trust or miller trust is a program that allows for medicaid eligibility specifically for seniors with a high income. A qualified income trust, sometimes called a “miller trust” or a “qit,” is a trust you can establish to qualify for medicaid or to maintain your income eligibility for medicaid. A qualified income. The property to be placed in the trust is the income received by the primary. The purpose of this trust is to enable the settlor, (also referred to herein as the beneficiary), to. Miller trusts, also called qualified income trusts, provide a way for nursing home medicaid and medicaid waiver applicants who have income over medicaid’s limit to become. A. A qualified income trust, or qit, is a trust that medicaid requires if a medicaid applicant has a monthly gross income of more than three times the ssi poverty limit, medicaid will deny the. The purpose of this trust is to assure eligibility of the primary beneficiary for medical assistance program benefits. A qualified income trust, sometimes called a “miller. A qualified income trust, sometimes called a “miller trust” or a “qit,” is a trust you can establish to qualify for medicaid or to maintain your income eligibility for medicaid. The purpose of this trust is to assure eligibility of the primary beneficiary for medical assistance program benefits. Qit frequently asked questions (faqs) qualified income trust template : A qit otherwise known as a qualified income trust or miller trust is a program that allows for medicaid eligibility specifically for seniors with a high income. The proper use of a qit allows a person to legally divert income into a trust, after which the income is not counted to determine medicaid eligibility for institutional or home and. Overview of qualified income trusts : The qualified income trust (qit) deals only with income. The trust makes it possible for that. What medicaid applicants need to tell a bank when establishing a qualified. But even if your monthly income is over that. To qualify for medicaid long term care, you or your loved one must meet certain financial requirements, including an income limit. The property to be placed in the trust is the income received by the primary. Basic information about the use of a qualified income trust (qit) (sometimes referred to as a miller trust) to establish income eligibility for managed long term services and supports. The trust shall be known as the qualified income trust. first: The purpose of this trust is to enable the settlor, (also referred to herein as the beneficiary), to. A miller trust (also known as a qualified income trust) is designed to own income in order for an individual to get around medicaid’s income caps.Qualified Trust Osterhout & McKinney, PA

Fillable Online owsfk Qualified Trust Form. Qualified

Fillable Online afgst viewdns Qualified Trust Form. qualified

Tennessee Qualified Trust Form Complete with ease airSlate

Form Trust Qualified ≡ Fill Out Printable PDF Forms Online

Qit Approved Qualified Trust Form Fill Online, Printable

Qualified Trusts (aka Miller Trusts) EZ Elder Law

QIT What is a Florida Medicaid Qualified Trust?

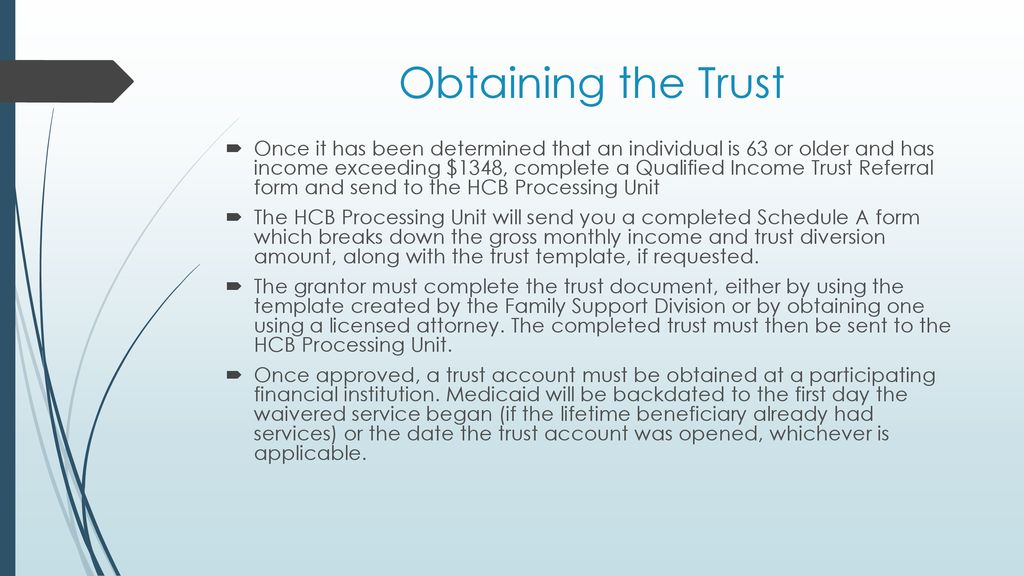

Qualified Trust ppt download

Fillable Online dads state tx Qualified Trust QIT CoPayment

Miller Trusts, Also Called Qualified Income Trusts, Provide A Way For Nursing Home Medicaid And Medicaid Waiver Applicants Who Have Income Over Medicaid’s Limit To Become.

This Trust Is A Qualified Income Tr Ust As Provided By Section 1917 (D)(4)(B) Of The Social Security Act As Amended Under Obra 93, And All Regulations Promulgated Thereunder.

Not Everyone Will Benefit From A Qualified.

The Qit Needs To Be Established And Properly Funded The Month The Applicant Is Otherwise Eligible For Medicaid Benefits.

Related Post: