Private Foundation Restricted Grant Template

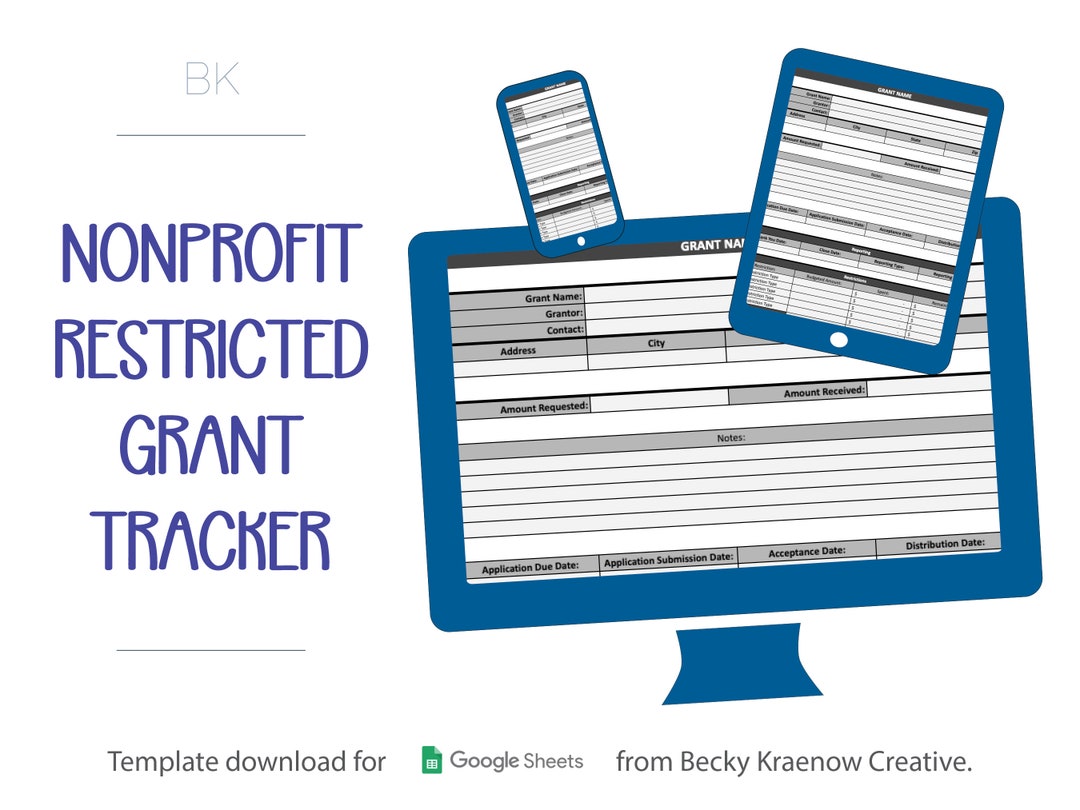

Private Foundation Restricted Grant Template - The grantee will treat the grant amount as a restricted asset and will keep accurate records to document the expenditure of funds and the activities supported by the grant. Permitted purposes are religious, charitable, scientific, literary or. Without added irs language this is sample letter for a grant from a private foundation to a section 501(c)(3) charitable. This grant agreement (agreement) is effective as of _____ (the effective date), between the following parties (individually party and collectively the parties): If the endowment is held by a 501c3, and that 501c3 is a private foundation, then such a loan would be a self dealing violation. Oftentimes, grantmakers can rely on the rules applicable to private foundations or even their state’s nonprofit corporation law when seeking answers to thorny grantmaking questions. Below is a sample grant letter for a general or project support from a public foundation to a section 501(c)(3) charitable organization. Activities will be conducted consistent. Clients can use the community foundation to. Sample fund agreements & policies. The following is a sample grant agreement letter from a private foundation to a section 501(c)(3) public charity. This grant agreement (agreement) is effective as of _____ (the effective date), between the following parties (individually party and collectively the parties): Last year, the foundation made 106 grants. Sample grant agreement for a private foundation. Oftentimes, grantmakers can rely on the rules applicable to private foundations or even their state’s nonprofit corporation law when seeking answers to thorny grantmaking questions. A grant agreement that bars all “political activities” can unnecessarily limit nonprofits. Example of an unrestricted grant. Increasingly we are seeing restricted gifts from donor advised funds. A private foundation cannot make a grant for a purpose not described in section 170(c)(2)(b) of the internal revenue code. Acknowledge that the foundation has not earmarked grant funds to support lobbying activities or to otherwise support attempts to influence legislation. A grant agreement that bars all “political activities” can unnecessarily limit nonprofits. Activities will be conducted consistent. Oftentimes, grantmakers can rely on the rules applicable to private foundations or even their state’s nonprofit corporation law when seeking answers to thorny grantmaking questions. Some foundation executives, boards or counsel may feel more comfortable with. Sample grant agreement for a private foundation. The source is most likely from a private foundation or a governmental entity or agency. Increasingly we are seeing restricted gifts from donor advised funds. The following is a sample grant agreement letter from a private foundation to a section 501(c)(3) public charity. A private foundation cannot make a grant for a purpose not described in section 170(c)(2)(b) of the. The grantee will treat the grant amount as a restricted asset and will keep accurate records to document the expenditure of funds and the activities supported by the grant. Below is a sample grant letter for a general or project support from a public foundation to a section 501(c)(3) charitable organization. A grant agreement that bars all “political activities” can. The grant qualifies as a prize or award that is excludible from gross income under internal revenue code section 74(b), if the recipient is selected from the general public. A grant agreement that bars all “political activities” can unnecessarily limit nonprofits. The grantee will treat the grant amount as a restricted asset and will keep accurate records to document the. The internal revenue code only prohibits “partisan political activities” that support or oppose candidates. Clients can use the community foundation to. Increasingly we are seeing restricted gifts from donor advised funds. Our legal resources team is available to provide members with sample documents and templates that can be customized to fit your foundation’s work or help guide your thinking. Some. Our legal resources team is available to provide members with sample documents and templates that can be customized to fit your foundation’s work or help guide your thinking. If the endowment is held by a 501c3, and that 501c3 is a private foundation, then such a loan would be a self dealing violation. Permitted purposes are religious, charitable, scientific, literary. Clients can use the community foundation to. This grant agreement (agreement) is effective as of _____ (the effective date), between the following parties (individually party and collectively the parties): Sample grant agreement for a private foundation. A private foundation cannot make a grant for a purpose not described in section 170(c)(2)(b) of the internal revenue code. The internal revenue code. Below is a sample grant letter for a general or project support from a public foundation to a section 501(c)(3) charitable organization. Activities will be conducted consistent. Increasingly we are seeing restricted gifts from donor advised funds. Foundation grant proposal template [your organization’s name] proposal to [foundation name] [date] i. A private foundation cannot make a grant for a purpose. Oftentimes, grantmakers can rely on the rules applicable to private foundations or even their state’s nonprofit corporation law when seeking answers to thorny grantmaking questions. Activities will be conducted consistent. Last year, the foundation made 106 grants. The following is a sample grant agreement letter from a private foundation to a section 501(c)(3) public charity. Example of an unrestricted grant. Some foundation executives, boards or counsel may feel more comfortable with. Even if the 501c3 is a public charity, then it must. A grant agreement that bars all “political activities” can unnecessarily limit nonprofits. A private foundation cannot make a grant for a purpose not described in section 170(c)(2)(b) of the internal revenue code. Permitted purposes are religious, charitable, scientific,. The letter is one example of how to include Example of an unrestricted grant. Clients can use the community foundation to. The grant qualifies as a prize or award that is excludible from gross income under internal revenue code section 74(b), if the recipient is selected from the general public. If the endowment is held by a 501c3, and that 501c3 is a private foundation, then such a loan would be a self dealing violation. Activities will be conducted consistent. The grantee will treat the grant amount as a restricted asset and will keep accurate records to document the expenditure of funds and the activities supported by the grant. The internal revenue code only prohibits “partisan political activities” that support or oppose candidates. Permitted purposes are religious, charitable, scientific, literary or. A grant agreement that bars all “political activities” can unnecessarily limit nonprofits. Last year, the foundation made 106 grants. Acknowledge that the foundation has not earmarked grant funds to support lobbying activities or to otherwise support attempts to influence legislation. A private foundation cannot make a grant for a purpose not described in section 170(c)(2)(b) of the internal revenue code. Without added irs language this is sample letter for a grant from a private foundation to a section 501(c)(3) charitable. Sample grant agreement for a private foundation. Below is a sample grant letter for a general or project support from a public foundation to a section 501(c)(3) charitable organization.Nonprofit Restricted Grant Tracker Google Sheets Spreadsheet Template

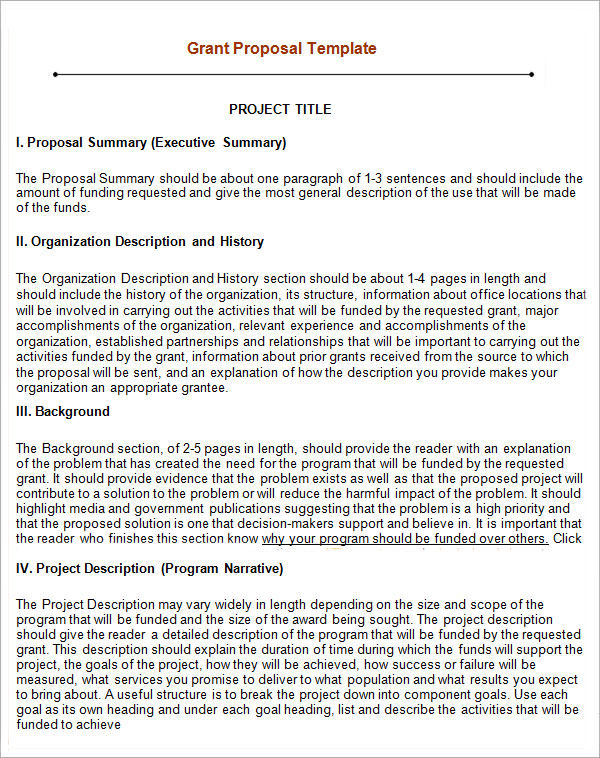

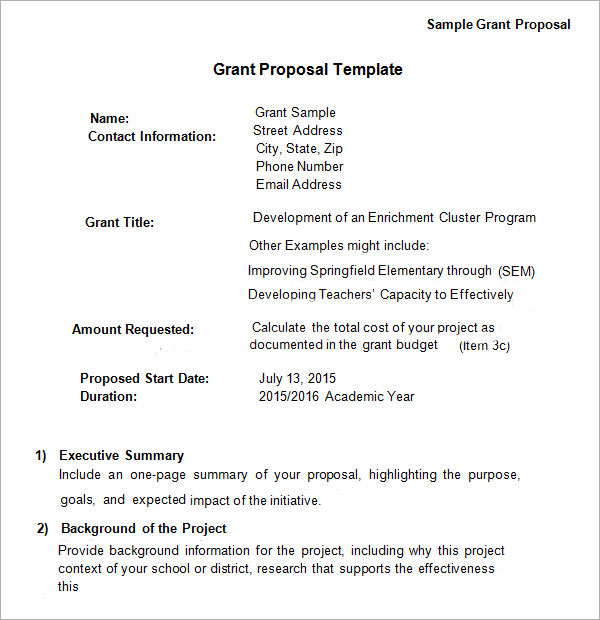

FREE 20+ Sample Grant Proposal Templates in PDF MS Word Pages

10 Foundations that Give Grants to Nonprofit OrganizationsGrant

40+ Grant Proposal Templates [NSF, NonProfit, Research] ᐅ TemplateLab

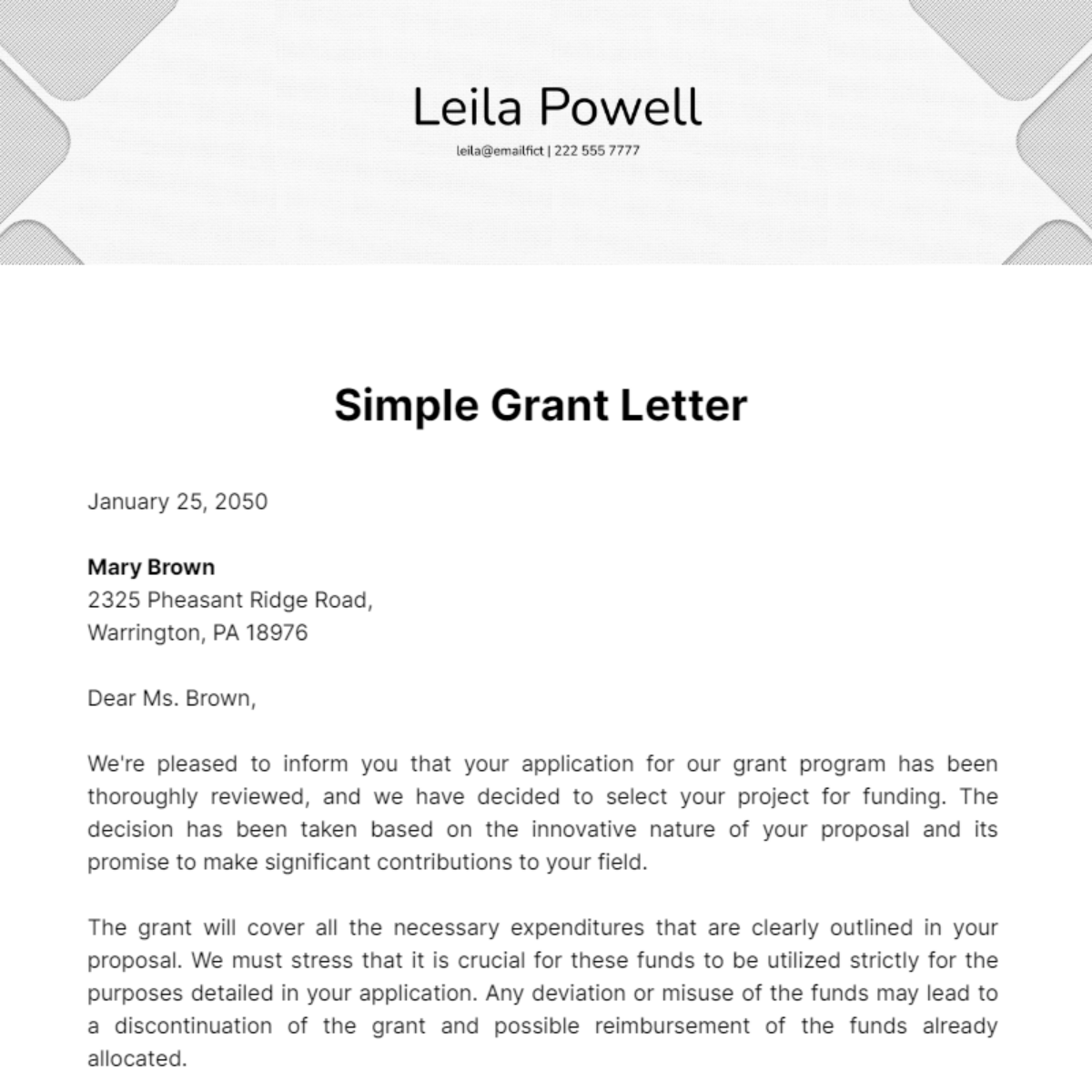

FREE Grant Letter Templates & Examples Edit Online & Download

40+ Grant Proposal Templates [NSF, NonProfit, Research] ᐅ TemplateLab

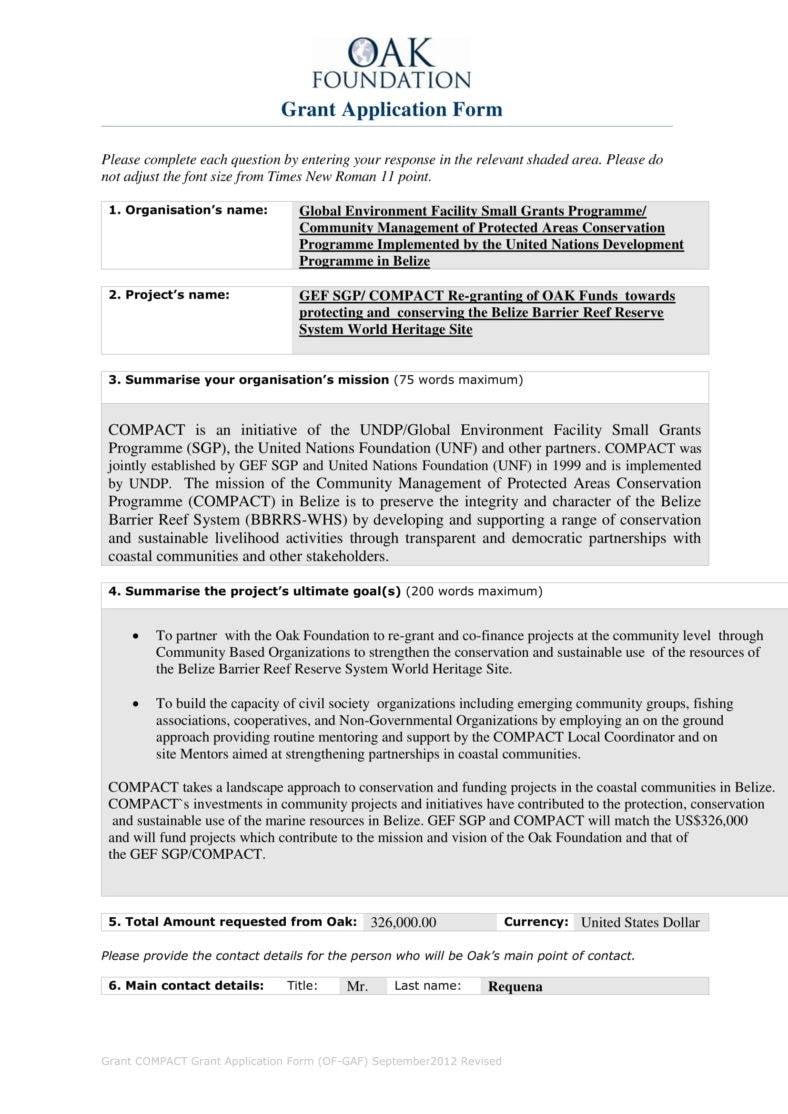

12+ Grant Application Form Templates PDF, Docs, Pages, Google Docs

40+ Grant Proposal Templates [NSF, NonProfit, Research] ᐅ TemplateLab

FREE 20+ Sample Grant Proposal Templates in PDF MS Word Pages

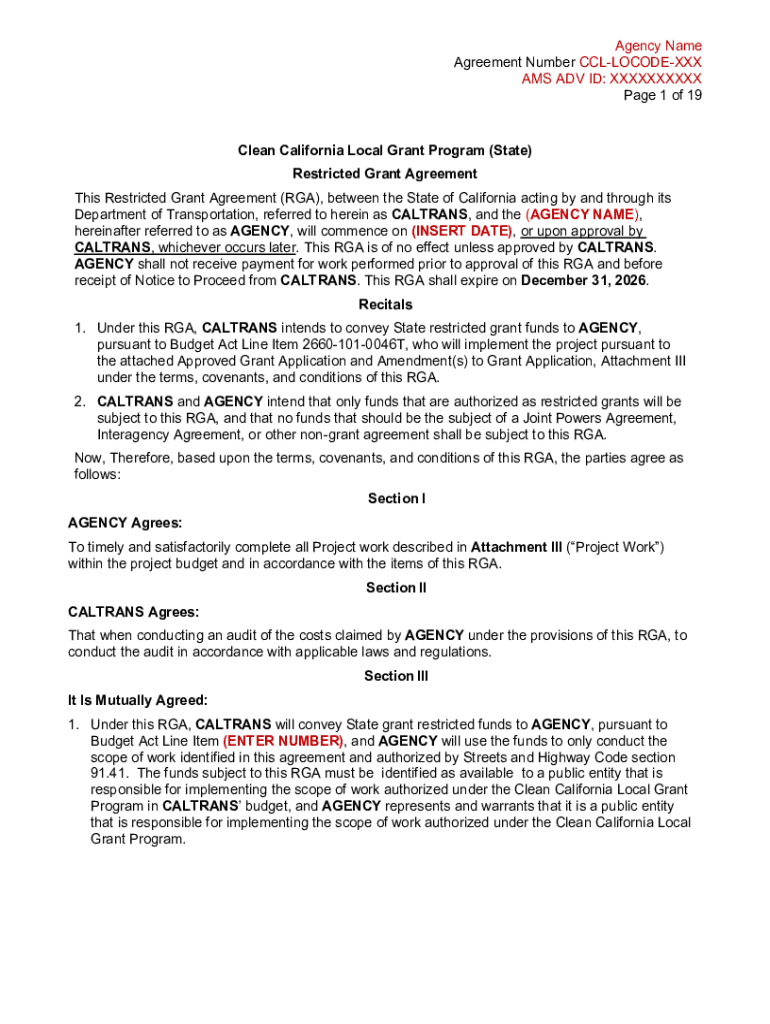

Fillable Online Cycle 2 Restricted Grant Agreement Template. Cycle 2

Some Foundation Executives, Boards Or Counsel May Feel More Comfortable With.

The Kinsman Foundation And The Grantee Are Entering Into This Agreement To Establish The Terms Of A Foundation Grant To The Grantee.

The Following Is A Sample Grant Agreement Letter From A Private Foundation To A Section 501(C)(3) Public Charity.

These Documents And Submittals Describe The Grantee’s.

Related Post:

![40+ Grant Proposal Templates [NSF, NonProfit, Research] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2017/08/grant-proposal-template-16.jpg?w=395)

![40+ Grant Proposal Templates [NSF, NonProfit, Research] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2017/08/grant-proposal-template-13.jpg?w=320)

![40+ Grant Proposal Templates [NSF, NonProfit, Research] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/08/grant-proposal-template-27.jpg?w=395)