Irs Business Name Change Letter Template

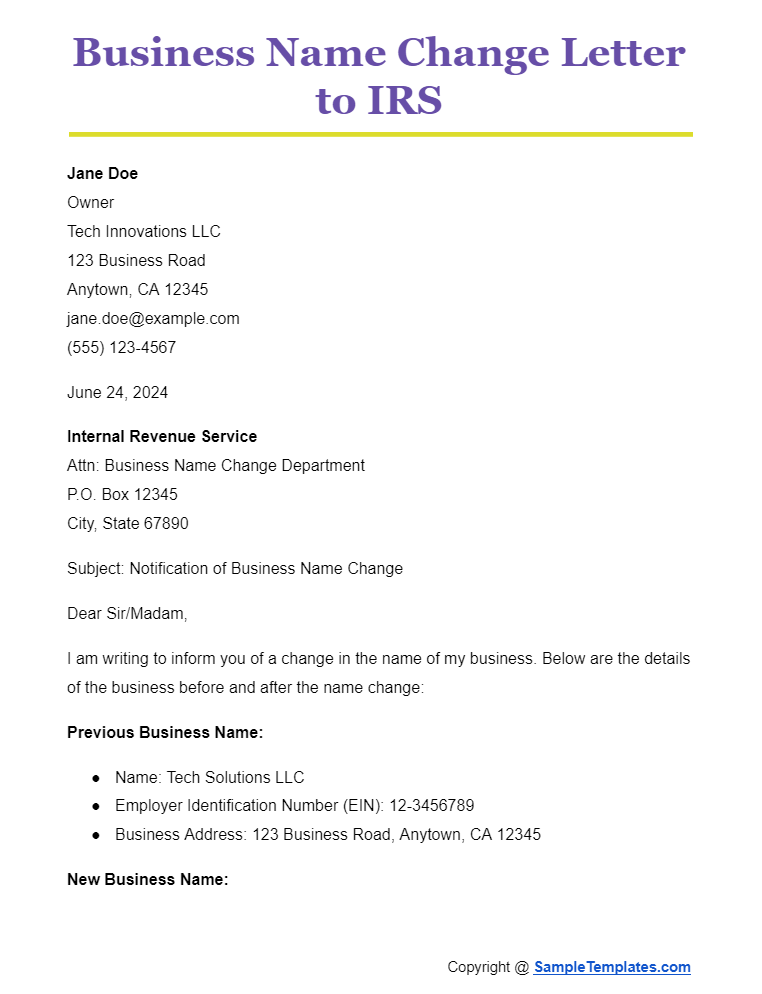

Irs Business Name Change Letter Template - It includes fields for the old and new company names, federal identification number, and contact. If your principal place of business is in the u.s., you can get an ein in these ways: In many cases, you can. This file is a template for an irs cover letter informing the irs of a company name change. Include the information when you file your annual. You can update your business name with the irs through a tax return form or by submitting a letter. Give the old and new business names, as well as your tax identification. Up to 8% cash back discover the four main steps to amending your company name and the benefits that can come with this legal change. If the ein was recently assigned and filing liability has yet to be determined, send business name. Write a letter to inform them of the name change. There are many things to consider before you opt for a name change. Write a letter to inform them of the name change. Get an ein now, free, direct from the irs. Learn how to write a professional business name change letter with our comprehensive guide. This step is essential to ensure that your business name is. In many cases, you can. If your principal place of business is in the u.s., you can get an ein in these ways: Write a letter to the irs processing center where you sent your tax return, if you are the owner of a sole proprietorship. It includes fields for the old and new company names, federal identification number, and contact. If the ein was recently assigned and filing liability has yet to be determined, send business name. Give the old and new business names, as well as your tax identification. Learn how to write a professional business name change letter with our comprehensive guide. Write a letter to the irs processing center where you sent your tax return, if you are the owner of a sole proprietorship. Write a letter requesting a name change to the irs.. It includes fields for the old and new company names, federal identification number, and contact. Write a letter requesting a name change to the irs. Just write a letter (on business letterhead) to the irs at the appropriate address noted in the instructions to the 1065 explaining that you changed from a partnership to an llc. Changing a business name. (i) the ein number for the business, (ii) the old business name, and (iii) the. For detailed guidelines, refer to irs publication 1635. Get an ein now, free, direct from the irs. Our business filing specialists will help you prepare your irs change letters and forms and provide you with detailed instructions on how to submit them to the irs.. The ein number for the business, the old business name, as well as the. Give the old and new business names, as well as your tax identification. Different forms apply based on business structure: If the ein was recently assigned and filing liability has yet to be determined, send business name. Visit the irs web page, business name change to. It must also include your employer identification number (ein) or social. (i) the ein number for the business, (ii) the old business name, and (iii) the. Write a letter to the irs processing center where you sent your tax return, if you are the owner of a sole proprietorship. Different forms apply based on business structure: Discover the key elements. This file is a template for an irs cover letter informing the irs of a company name change. Visit the irs web page, business name change to get directions. If your principal place of business is in the u.s., you can get an ein in these ways: Business owners and other authorized individuals can submit a name change for their. Write a letter to the irs processing center where you sent your tax return, if you are the owner of a sole proprietorship. If your principal place of business is in the u.s., you can get an ein in these ways: Corporations and llcs can check the name change box while filing their annual tax return. The specific action required. (i) the ein number for the business, (ii) the old business name, and (iii) the. Write a letter to inform them of the name change. It must also include your employer identification number (ein) or social. Get an ein now, free, direct from the irs. As your business evolves, you may find that your business name no longer fits what. Corporations and llcs can check the name change box while filing their annual tax return. Different forms apply based on business structure: Business owners and other authorized individuals can submit a name change for their business. Give the old and new business names, as well as your tax identification. If the ein was recently assigned and filing liability has yet. The letter to the irs will vary depending on your type of business. The letter must clearly state your old name and the new name. If your principal place of business is in the u.s., you can get an ein in these ways: Write a letter requesting a name change to the irs. For detailed guidelines, refer to irs publication. Business owners and other authorized individuals can submit a name change for their business. If the ein was recently assigned and filing liability has yet to be determined, send business name. In many cases, you can. It must also include your employer identification number (ein) or social. As your business evolves, you may find that your business name no longer fits what you do. This step is essential to ensure that your business name is. Learn how to write a professional business name change letter with our comprehensive guide. You can update your business name with the irs through a tax return form or by submitting a letter. Give the old and new business names, as well as your tax identification. This file is a template for an irs cover letter informing the irs of a company name change. Get an ein now, free, direct from the irs. The letter must clearly state your old name and the new name. For detailed guidelines, refer to irs publication 1635. The ein number for the business, the old business name, as well as the. Just write a letter (on business letterhead) to the irs at the appropriate address noted in the instructions to the 1065 explaining that you changed from a partnership to an llc. It includes fields for the old and new company names, federal identification number, and contact.Business Name Change Letter Template To Irs

Sample Letter To Irs For Business Name Change

How To Change Your Business Name With The IRS LiveWell

Irs Business Name Change Letter Template prntbl

Sample Letter To Irs For Business Name Change

Verifying your business for Squarespace Payments Squarespace Help Center

Business Name Change Irs Sample Letter / Irs Business Name Change

FREE 12+ Sample Business Name Change Letter Templates in Word, PDF

Irs Business Name Change Letter Template

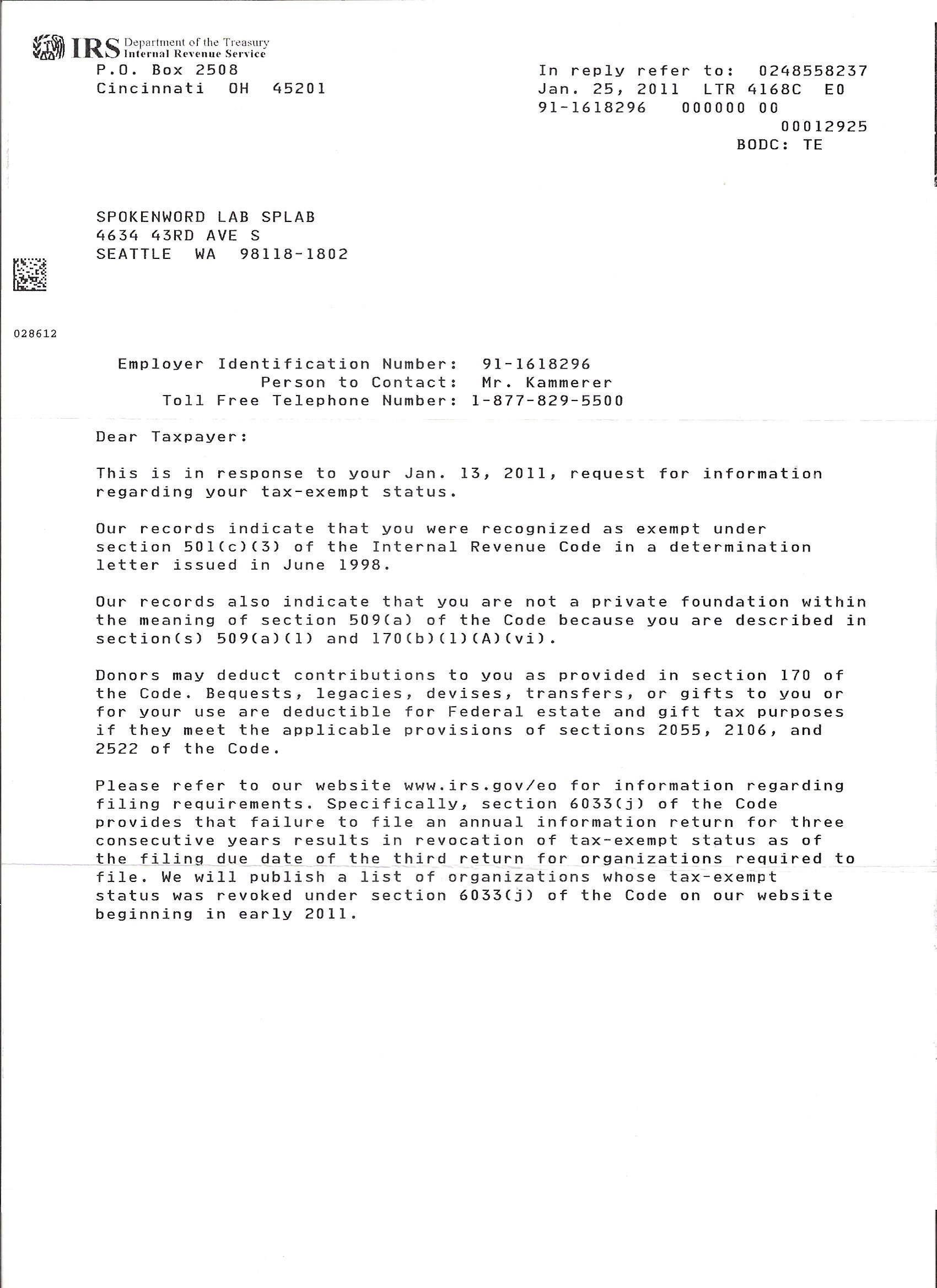

Using IRS documentation as reference when entering business name and

Write A Letter To The Irs Processing Center Where You Sent Your Tax Return, If You Are The Owner Of A Sole Proprietorship.

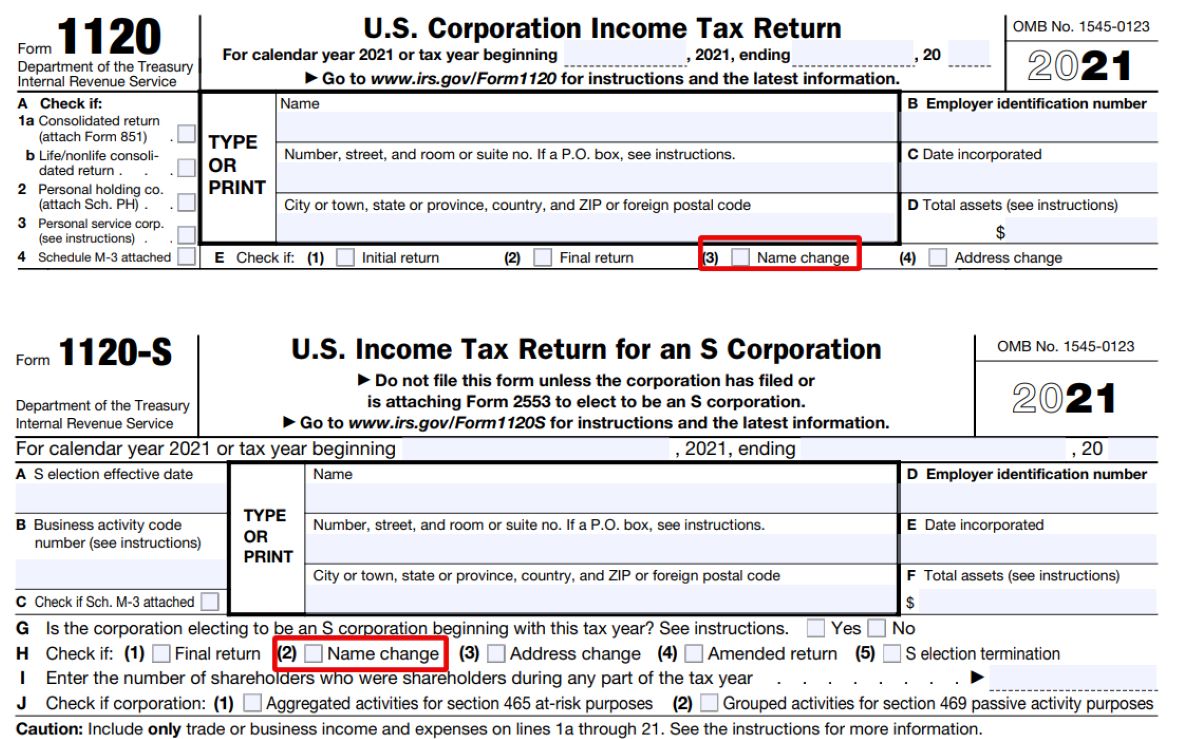

Corporations And Llcs Can Check The Name Change Box While Filing Their Annual Tax Return.

Up To 8% Cash Back Discover The Four Main Steps To Amending Your Company Name And The Benefits That Can Come With This Legal Change.

(I) The Ein Number For The Business, (Ii) The Old Business Name, And (Iii) The.

Related Post: