Ein Name Change Letter Template

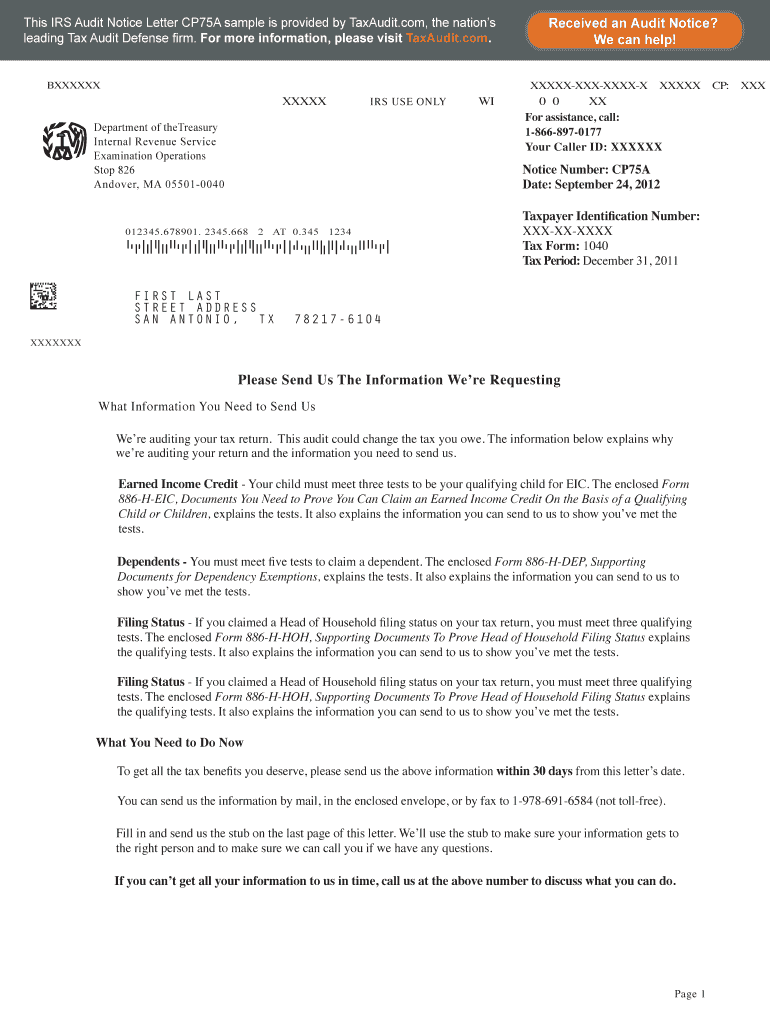

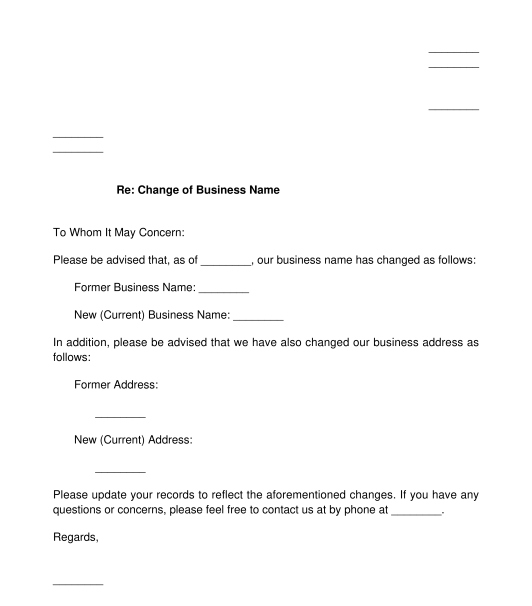

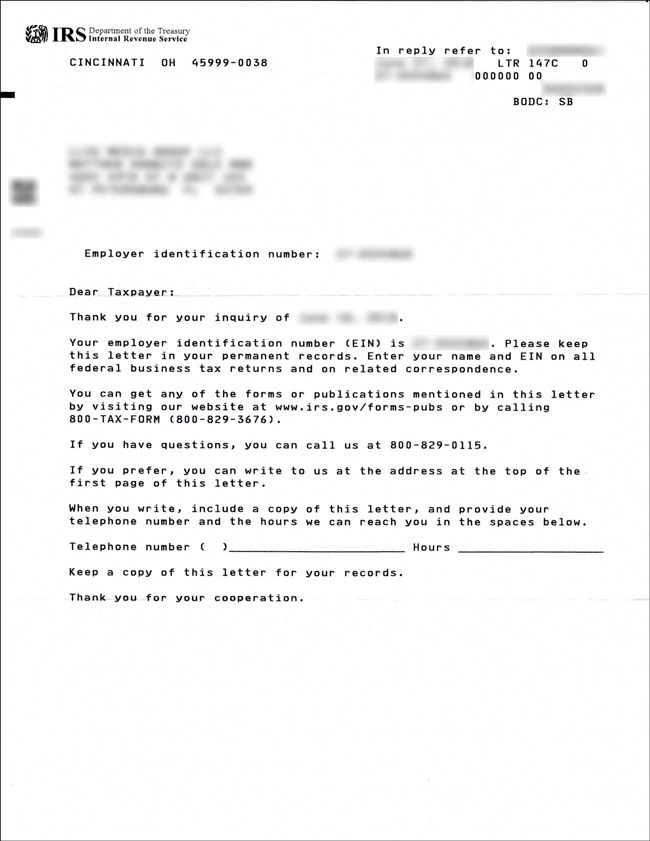

Ein Name Change Letter Template - The specific action required may vary depending on the type of business. The easiest and fastest option available is to write to the irs directly to let them know about your business’s new name and to request an ein verification letter. People who change their legal names can inform banks, creditors and other organizations of the change using this free, printable notification. The irs will automatically update the business name associated with your current ein after you send the name change letter and certificate of amendment to the appropriate. You can also download it, export it or print it out. If the ein was recently assigned and filing liability has yet to be determined, send business name. Most business name changes do not require a new ein, but the irs must be informed. Up to 40% cash back send ein name change letter template via email, link, or fax. Visit the irs web page, business name change to get directions. Up to 40% cash back make any adjustments required: The specific action required may vary depending on the type of business. The ein number for the business, the old business name, as well as the. Most business name changes do not require a new ein, but the irs must be informed. Business owners and other authorized individuals can submit a name change for their business. Up to $40 cash back a sample letter to the irs for a business name change should include your business's old name, the new name, employer identification number (ein), date of name. Insert text and images to your ein name change letter template, underline important details, erase parts of content and replace them. To update your business name on an ein, notify the irs following guidelines specific to your business entity type. Up to 40% cash back make any adjustments required: The method you use to notify the irs of the name change depends on the type of business you have. People who change their legal names can inform banks, creditors and other organizations of the change using this free, printable notification. The method you use to notify the irs of the name change depends on the type of business you have. People who change their legal names can inform banks, creditors and other organizations of the change using this free, printable notification. Visit the irs web page, business name change to get directions. To update your business name on an ein,. You can also download it, export it or print it out. Most business name changes do not require a new ein, but the irs must be informed. Up to 40% cash back send ein name change letter template via email, link, or fax. The method you use to notify the irs of the name change depends on the type of. The method you use to notify the irs of the name change depends on the type of business you have. (i) the ein number for the business, (ii) the old business name, and (iii) the. Up to 40% cash back make any adjustments required: People who change their legal names can inform banks, creditors and other organizations of the change. You can also download it, export it or print it out. Up to 40% cash back send ein name change letter template via email, link, or fax. If restructuring (e.g., changing from an llc to a corporation), a new ein may be. If you change the legal name of your business, then as the owner, partner or corporate officer, you. Visit the irs web page, business name change to get directions. To update your business name on an ein, notify the irs following guidelines specific to your business entity type. Up to $40 cash back in your letter to the irs for a business name change, you should include your old business name, new business name, your business tax identification. You can also download it, export it or print it out. If restructuring (e.g., changing from an llc to a corporation), a new ein may be. Usually, changing your business name does not require you to obtain a new employer identification number (ein). Insert text and images to your ein name change letter template, underline important details, erase parts of. To update your business name on an ein, notify the irs following guidelines specific to your business entity type. Up to $40 cash back in your letter to the irs for a business name change, you should include your old business name, new business name, your business tax identification number (ein),. The irs will automatically update the business name associated. Up to 40% cash back make any adjustments required: Insert text and images to your ein name change letter template, underline important details, erase parts of content and replace them. The specific action required may vary depending on the type of business. Sole proprietors can send a letter detailing the old and. Up to $40 cash back in your letter. Usually, changing your business name does not require you to obtain a new employer identification number (ein). Sole proprietors can send a letter detailing the old and. You can also download it, export it or print it out. The easiest and fastest option available is to write to the irs directly to let them know about your business’s new name. Visit the irs web page, business name change to get directions. Most business name changes do not require a new ein, but the irs must be informed. Up to 40% cash back make any adjustments required: If you change the legal name of your business, then as the owner, partner or corporate officer, you are authorized to file the name. If restructuring (e.g., changing from an llc to a corporation), a new ein may be. The easiest and fastest option available is to write to the irs directly to let them know about your business’s new name and to request an ein verification letter. However, you must update the name on your ein. If you change the legal name of your business, then as the owner, partner or corporate officer, you are authorized to file the name change with the internal revenue service. Up to $40 cash back in your letter to the irs for a business name change, you should include your old business name, new business name, your business tax identification number (ein),. You can also download it, export it or print it out. Up to 40% cash back make any adjustments required: Insert text and images to your ein name change letter template, underline important details, erase parts of content and replace them. Up to $40 cash back a sample letter to the irs for a business name change should include your business's old name, the new name, employer identification number (ein), date of name. People who change their legal names can inform banks, creditors and other organizations of the change using this free, printable notification. The specific action required may vary depending on the type of business. (i) the ein number for the business, (ii) the old business name, and (iii) the. The letter to the irs will vary depending on your type of business. The irs will automatically update the business name associated with your current ein after you send the name change letter and certificate of amendment to the appropriate. If the ein was recently assigned and filing liability has yet to be determined, send business name. To update your business name on an ein, notify the irs following guidelines specific to your business entity type.Name Change Letter Free Printable Documents

Sample Letter To Irs For Business Name Change

Business Name Change Letter Template To Irs

Irs Business Name Change Letter Template

Irs Name Change Letter Sample Irs Name Change Letter Sample 20

Business Name Change Irs Sample Letter / Lovely Irs Ein Name Change

Irs Business Name Change Letter Template

Irs Business Name Change Letter Template

FREE 12+ Sample Business Name Change Letter Templates in Word, PDF

Business Name Change Irs Sample Letter Irs Ein Name Change Form

The Method You Use To Notify The Irs Of The Name Change Depends On The Type Of Business You Have.

Most Business Name Changes Do Not Require A New Ein, But The Irs Must Be Informed.

Visit The Irs Web Page, Business Name Change To Get Directions.

Write A Letter To Inform Them Of The Name Change.

Related Post: