Donation Letter Tax Deduction Template

Donation Letter Tax Deduction Template - This customizable document, available for download in ms word and google docs formats,. Charity organizations, such as 501(c)(3) nonprofit entities in the united states, must provide donors with official donation receipts following irs guidelines to ensure tax. Making charitable donations not only helps worthy causes but can also provide significant tax benefits. This designation allows donors to claim charitable donation tax deductions, providing financial incentives for contributions. How to write a tax deductible donation letter? A church donation letter for tax purposes is a formal document that certifies a charitable donation from an individual or organization to a church and allows the donor to claim a tax. These letters serve as official documentation for tax purposes,. Charitable organizations often provide tax deduction acknowledgment letters to donors for their contributions. Contents of written acknowledgment required to substantiate deduction. In addition, a donor may claim a deduction for contributions of cash, check, or other monetary gifts only if the donor maintains certain written records. Charitable organizations often provide tax deduction acknowledgment letters to donors for their contributions. This designation allows donors to claim charitable donation tax deductions, providing financial incentives for contributions. As nonprofits are faced with higher. Refer to the example templates to frame a personalized and professional draft. Making charitable donations not only helps worthy causes but can also provide significant tax benefits. Understanding how tax deductions work for charitable contributions. Download this tax deductible donation letter template now! How to write a tax deductible donation letter? For example, a donation of $100 made on march 15, 2023, to a 501(c)(3) organization can provide the donor with a record of their contribution for tax filing purposes. Charity organizations, such as 501(c)(3) nonprofit entities in the united states, must provide donors with official donation receipts following irs guidelines to ensure tax. A church donation letter for tax purposes is a formal document that certifies a charitable donation from an individual or organization to a church and allows the donor to claim a tax. This customizable document, available for download in ms word and google docs formats,. In addition, a donor may claim a deduction for contributions of cash, check, or other. This designation allows donors to claim charitable donation tax deductions, providing financial incentives for contributions. A church donation letter for tax purposes is a formal document that certifies a charitable donation from an individual or organization to a church and allows the donor to claim a tax. These letters serve as official documentation for tax purposes,. Learn to write tax. Charity organizations, such as 501(c)(3) nonprofit entities in the united states, must provide donors with official donation receipts following irs guidelines to ensure tax. This customizable document, available for download in ms word and google docs formats,. For example, a donation of $100 made on march 15, 2023, to a 501(c)(3) organization can provide the donor with a record of. Charity organizations, such as 501(c)(3) nonprofit entities in the united states, must provide donors with official donation receipts following irs guidelines to ensure tax. In addition, a donor may claim a deduction for contributions of cash, check, or other monetary gifts only if the donor maintains certain written records. Making charitable donations not only helps worthy causes but can also. Download or preview 2 pages of pdf version of sample tax deductible letter to donor (doc: How to write a tax deductible donation letter? Return to life cycle of a public charity. These letters serve as official documentation for tax purposes,. In addition, a donor may claim a deduction for contributions of cash, check, or other monetary gifts only if. These letters serve as official documentation for tax purposes,. This designation allows donors to claim charitable donation tax deductions, providing financial incentives for contributions. Return to life cycle of a public charity. In addition, a donor may claim a deduction for contributions of cash, check, or other monetary gifts only if the donor maintains certain written records. Learn to write. As nonprofits are faced with higher. For example, a donation of $100 made on march 15, 2023, to a 501(c)(3) organization can provide the donor with a record of their contribution for tax filing purposes. A church donation letter for tax purposes is a formal document that certifies a charitable donation from an individual or organization to a church and. Contents of written acknowledgment required to substantiate deduction. As nonprofits are faced with higher. In addition, a donor may claim a deduction for contributions of cash, check, or other monetary gifts only if the donor maintains certain written records. Understanding how tax deductions work for charitable contributions. Return to life cycle of a public charity. Making charitable donations not only helps worthy causes but can also provide significant tax benefits. As nonprofits are faced with higher. This customizable document, available for download in ms word and google docs formats,. Charitable organizations often provide tax deduction acknowledgment letters to donors for their contributions. A church donation letter for tax purposes is a formal document that certifies. Making charitable donations not only helps worthy causes but can also provide significant tax benefits. Charity organizations, such as 501(c)(3) nonprofit entities in the united states, must provide donors with official donation receipts following irs guidelines to ensure tax. Contents of written acknowledgment required to substantiate deduction. How to write a tax deductible donation letter? In addition, a donor may. Refer to the example templates to frame a personalized and professional draft. A church donation letter for tax purposes is a formal document that certifies a charitable donation from an individual or organization to a church and allows the donor to claim a tax. As nonprofits are faced with higher. Learn to write tax deductible donation letter in a formally pleasant tone. Making charitable donations not only helps worthy causes but can also provide significant tax benefits. Contents of written acknowledgment required to substantiate deduction. These letters serve as official documentation for tax purposes,. Download this tax deductible donation letter template now! Charitable organizations often provide tax deduction acknowledgment letters to donors for their contributions. 58.7 kb ) for free. How to write a tax deductible donation letter? This customizable document, available for download in ms word and google docs formats,. This designation allows donors to claim charitable donation tax deductions, providing financial incentives for contributions. Return to life cycle of a public charity. Charity organizations, such as 501(c)(3) nonprofit entities in the united states, must provide donors with official donation receipts following irs guidelines to ensure tax.501c3 Tax Deductible Donation Letter Template Business

Tax Deductible Donation Thank You Letter Template Resume Letter

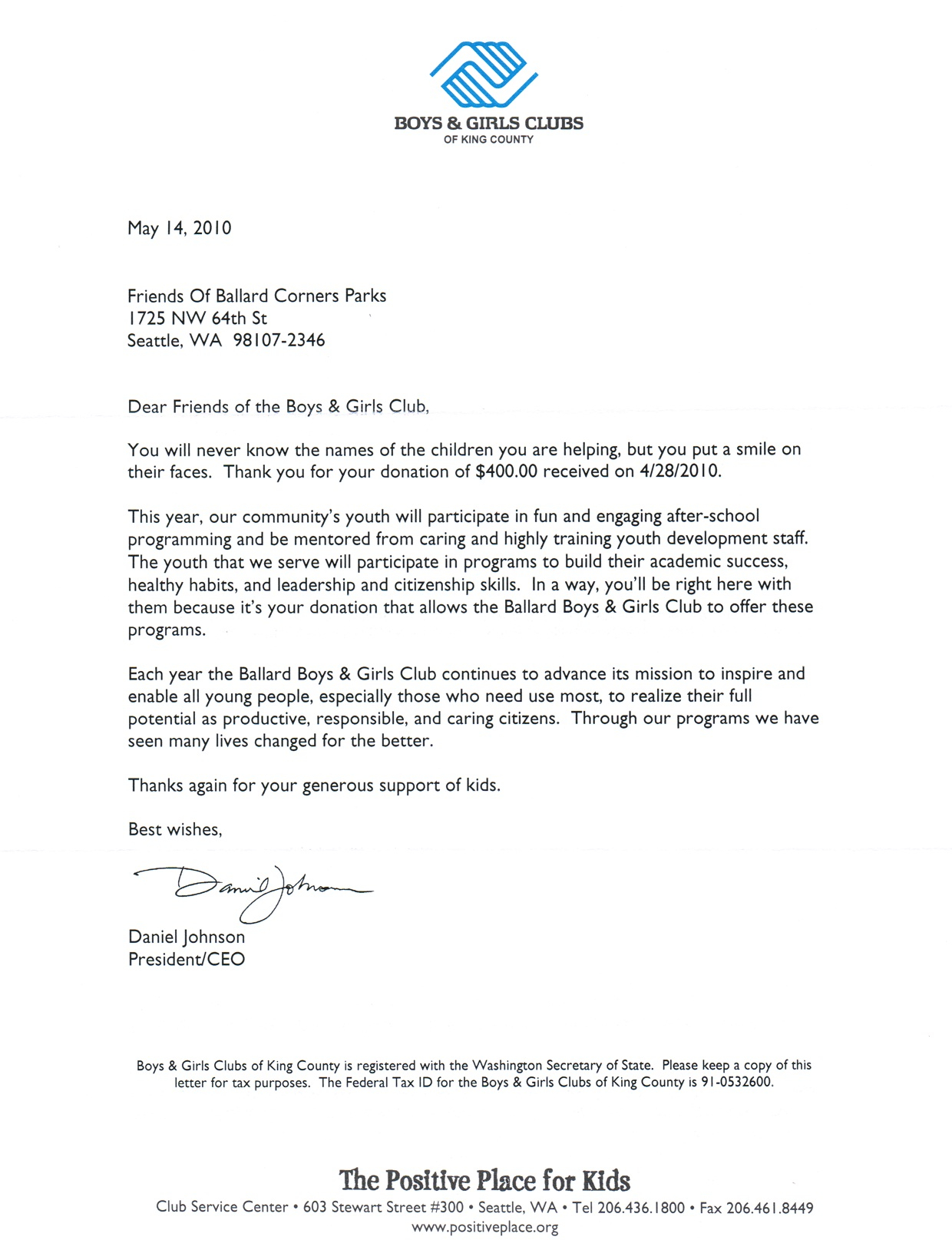

Donation Letter for Taxes Sample and Examples [Word]

Tax Deductible Donation Thank You Letter Template Examples Letter

501c3 Tax Deductible Donation Letter Sample with Examples

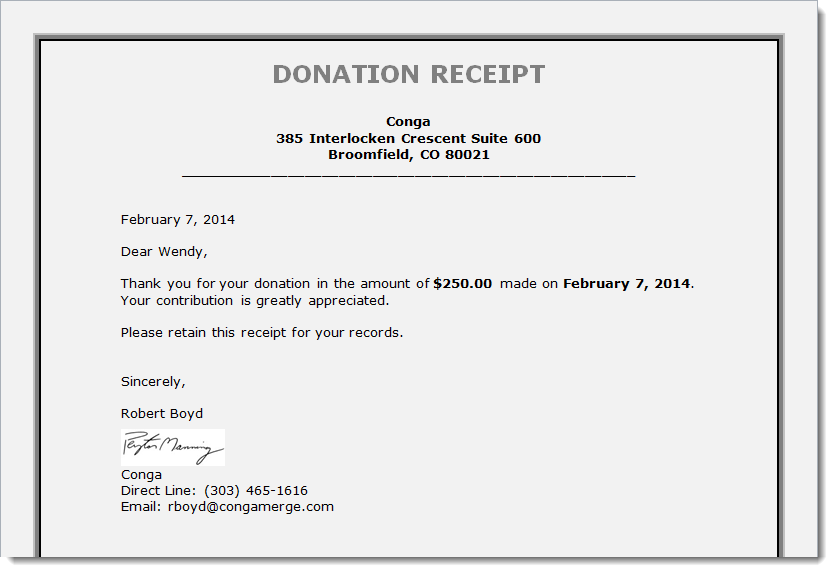

Get Our Printable Tax Deductible Donation Receipt Template Receipt

Tax Deductible Donation Thank You Letter Template Examples Letter

Donation Letter for Taxes Sample and Examples [Word]

Excellent Tax Donation Receipt Letter Template Authentic Receipt

Editable Tax Deductible Donation Letter Template Pdf Sample in 2021

Understanding How Tax Deductions Work For Charitable Contributions.

For Example, A Donation Of $100 Made On March 15, 2023, To A 501(C)(3) Organization Can Provide The Donor With A Record Of Their Contribution For Tax Filing Purposes.

In Addition, A Donor May Claim A Deduction For Contributions Of Cash, Check, Or Other Monetary Gifts Only If The Donor Maintains Certain Written Records.

Download Or Preview 2 Pages Of Pdf Version Of Sample Tax Deductible Letter To Donor (Doc:

Related Post:

![Donation Letter for Taxes Sample and Examples [Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2022/10/Donation-Letter-for-Taxes.jpg?fit=1414%2C2000&ssl=1)

![Donation Letter for Taxes Sample and Examples [Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2022/10/donation-letter-for-tax-purpose-pdf.jpg?fit=1414%2C1999&ssl=1)