Cp2000 Response Letter Template

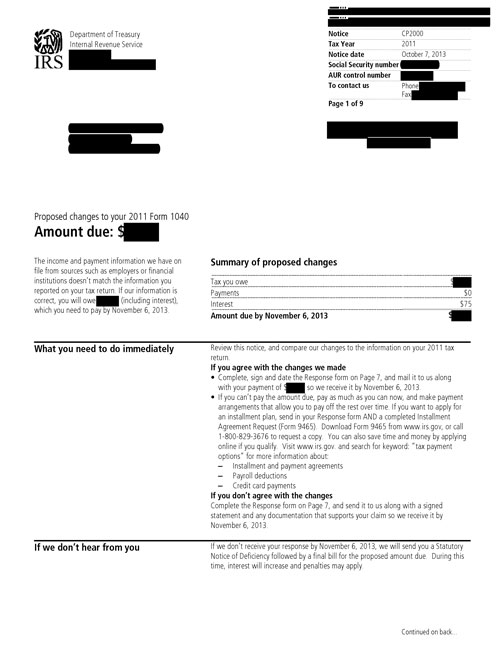

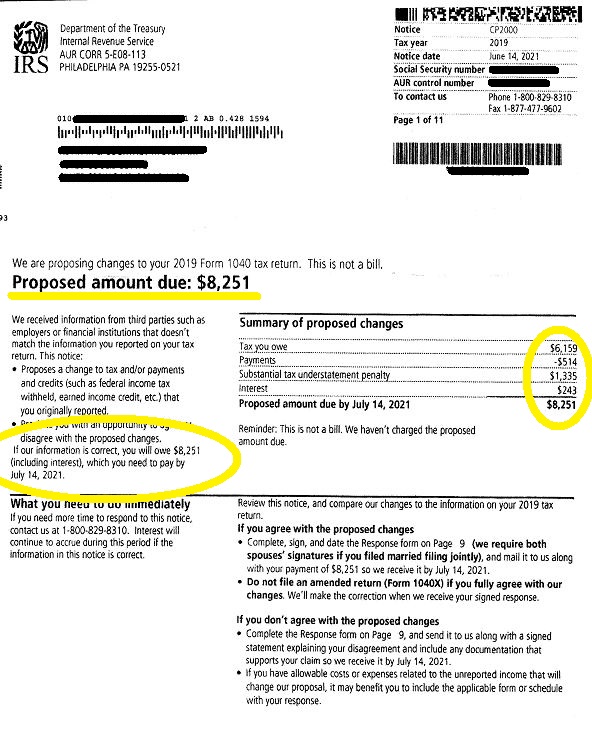

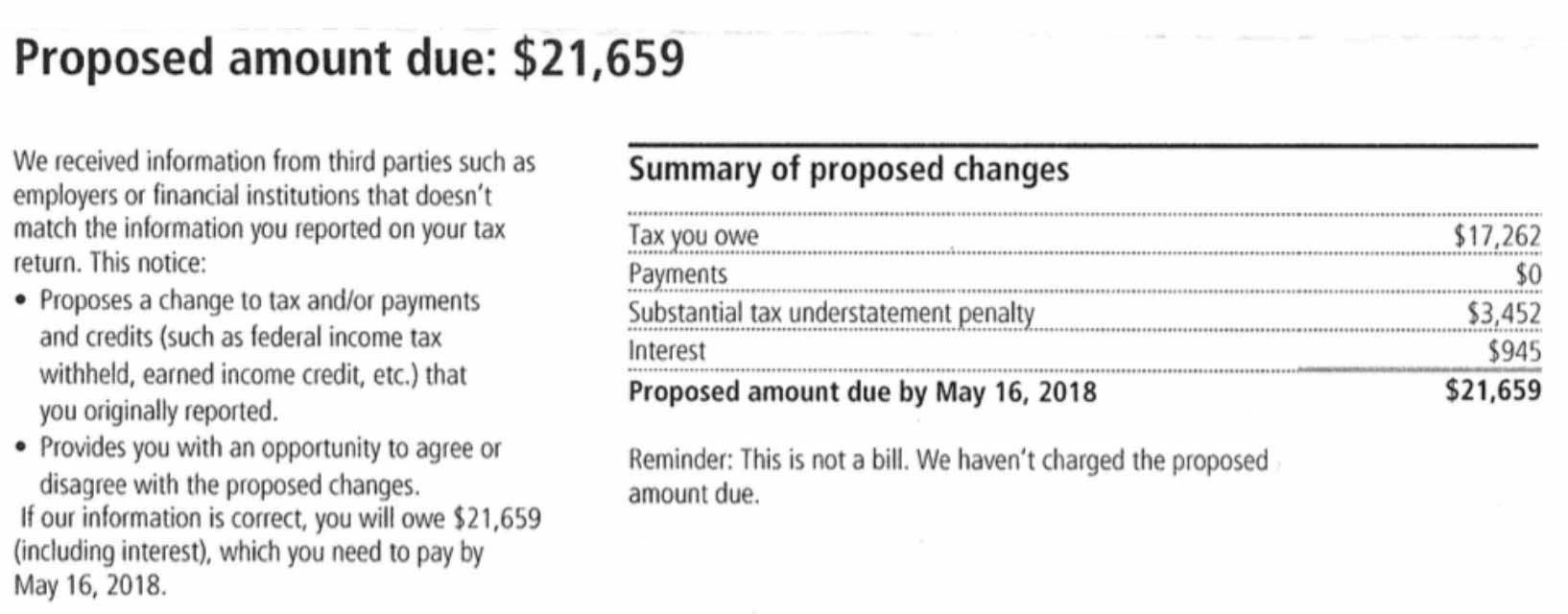

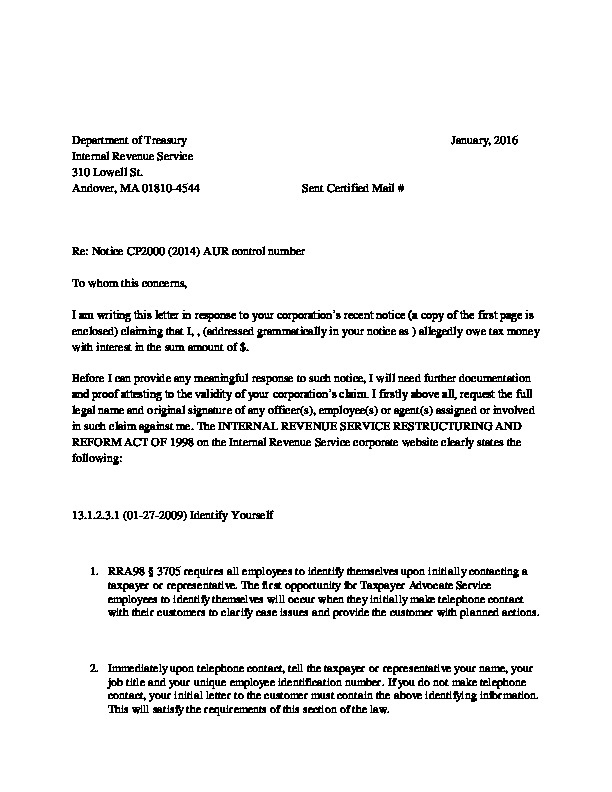

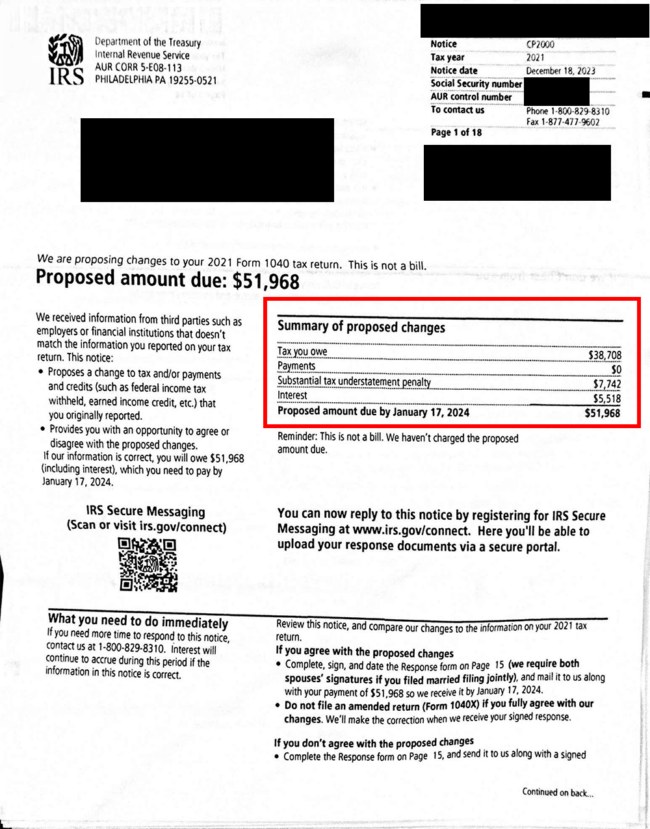

Cp2000 Response Letter Template - See the sample irs cp2000 response letter. Learn how to effectively craft a cp2000 response letter with key elements and submission tips to address irs inquiries. Include photocopies of any supporting. You have the right to contest penalties and appeal a. This specific letter is irs letter cp 2000. The first page of the notice provides a summary of proposed changes to your tax, a phone number to call for assistance, and the steps you should take to respond. Make a copy of this document so you can edit it → file > “make a copy” .</p> It requests documentation to prove the validity of the claim, including signed certifications and delegations of authority from. This sample letter guides individuals in responding to irs notice cp2000 regarding income discrepancies. Check out some sample cp2000 response letters here. See the sample irs cp2000 response letter. You do this by writing a letter to the irs and faxing it to the number on the cp2000. Check out some sample cp2000 response letters here. You have the right to contest penalties and appeal a. The letter is a response to a notice cp2000 claiming tax owed. Make a copy of this document so you can edit it → file > “make a copy” .</p> It is not a formal audit letter notice. It demonstrates how to reference the notice, explain the issue, provide. Check the i do not agree section of the response form and send a signed statement telling us why you don't agree. Complete the response form on page 5, and send it to us along with a signed statement and any documentation that supports your claim so we receive it by june 12, 2013. It demonstrates how to reference the notice, explain the issue, provide. This specific letter is irs letter cp 2000. You have the right to contest penalties and appeal a. The first page of the notice provides a summary of proposed changes to your tax, a phone number to call for assistance, and the steps you should take to respond. Make. However, it does notify the taxpayer that the agency found a discrepancy, and asks if the. Check the i do not agree section of the response form and send a signed statement telling us why you don't agree. You do this by writing a letter to the irs and faxing it to the number on the cp2000. Check out some. Complete the response form on page 5, and send it to us along with a signed statement and any documentation that supports your claim so we receive it by june 12, 2013. This sample letter guides individuals in responding to irs notice cp2000 regarding income discrepancies. Up to 8% cash back cp2000 notices aren’t audits, but they work the same.. It is not a formal audit letter notice. Learn how to effectively craft a cp2000 response letter with key elements and submission tips to address irs inquiries. It requests documentation to prove the validity of the claim, including signed certifications and delegations of authority from. However, it does notify the taxpayer that the agency found a discrepancy, and asks if. Up to $40 cash back in your sample response letter for irs cp2000, you should include a clear explanation of why you agree or disagree with the proposed changes, any supporting. Your response letter to the irs for the cp2000 should describe the items you disagree with, and the irs tax forms used in your calculation. It’s important to fully. If you choose to file an amended tax return, write “cp2000” along the top of the 1040x, attach it behind the response form page and send to the address shown on this notice. Complete the response form on page 5, and send it to us along with a signed statement and any documentation that supports your claim so we receive. It’s important to fully respond by the irs deadline. Check the i do not agree section of the response form and send a signed statement telling us why you don't agree. It requests documentation to prove the validity of the claim, including signed certifications and delegations of authority from. Include photocopies of any supporting. Up to $40 cash back in. You do this by writing a letter to the irs and faxing it to the number on the cp2000. It’s important to fully respond by the irs deadline. The letter is a response to a notice cp2000 claiming tax owed. Your response letter to the irs for the cp2000 should describe the items you disagree with, and the irs tax. Up to $40 cash back in your sample response letter for irs cp2000, you should include a clear explanation of why you agree or disagree with the proposed changes, any supporting. The first page of the notice provides a summary of proposed changes to your tax, a phone number to call for assistance, and the steps you should take to. Complete the response form on page 5, and send it to us along with a signed statement and any documentation that supports your claim so we receive it by june 12, 2013. Learn how to effectively craft a cp2000 response letter with key elements and submission tips to address irs inquiries. The letter is a response to a notice cp2000. If the cp2000 notice is correct and you have other income, credits or expenses to report: Up to $40 cash back in your sample response letter for irs cp2000, you should include a clear explanation of why you agree or disagree with the proposed changes, any supporting. You have the right to contest penalties and appeal a. Make a copy of this document so you can edit it → file > “make a copy” .</p> Check out some sample cp2000 response letters here. Learn how to effectively craft a cp2000 response letter with key elements and submission tips to address irs inquiries. The first page of the notice provides a summary of proposed changes to your tax, a phone number to call for assistance, and the steps you should take to respond. It requests documentation to prove the validity of the claim, including signed certifications and delegations of authority from. If you choose to file an amended tax return, write “cp2000” along the top of the 1040x, attach it behind the response form page and send to the address shown on this notice. See the sample irs cp2000 response letter. It is not a formal audit letter notice. Up to 8% cash back cp2000 notices aren’t audits, but they work the same. It demonstrates how to reference the notice, explain the issue, provide. The letter is a response to a notice cp2000 claiming tax owed. Your response letter to the irs for the cp2000 should describe the items you disagree with, and the irs tax forms used in your calculation. Complete the response form on page 5, and send it to us along with a signed statement and any documentation that supports your claim so we receive it by june 12, 2013.Cp2000 Response Letter Template Samples Letter Template Collection

Cp2000 Response Template

Sample Letter To Irs For Correction

Response To Cp2000 Letter

What Is a CP2000 IRS Notice? Plus, Response Letter Sample

Response To Cp2000 Letter

Response To Cp2000 Letter

CP2000 Crypto Letter How to Respond and Dispute Gordon Law

Response To Cp2000 Letter

Cp2000 Response Letter Template

Include Photocopies Of Any Supporting.

Check The I Do Not Agree Section Of The Response Form And Send A Signed Statement Telling Us Why You Don't Agree.

However, It Does Notify The Taxpayer That The Agency Found A Discrepancy, And Asks If The.

What If You Agree With The Irs?

Related Post: