1099 Int Template

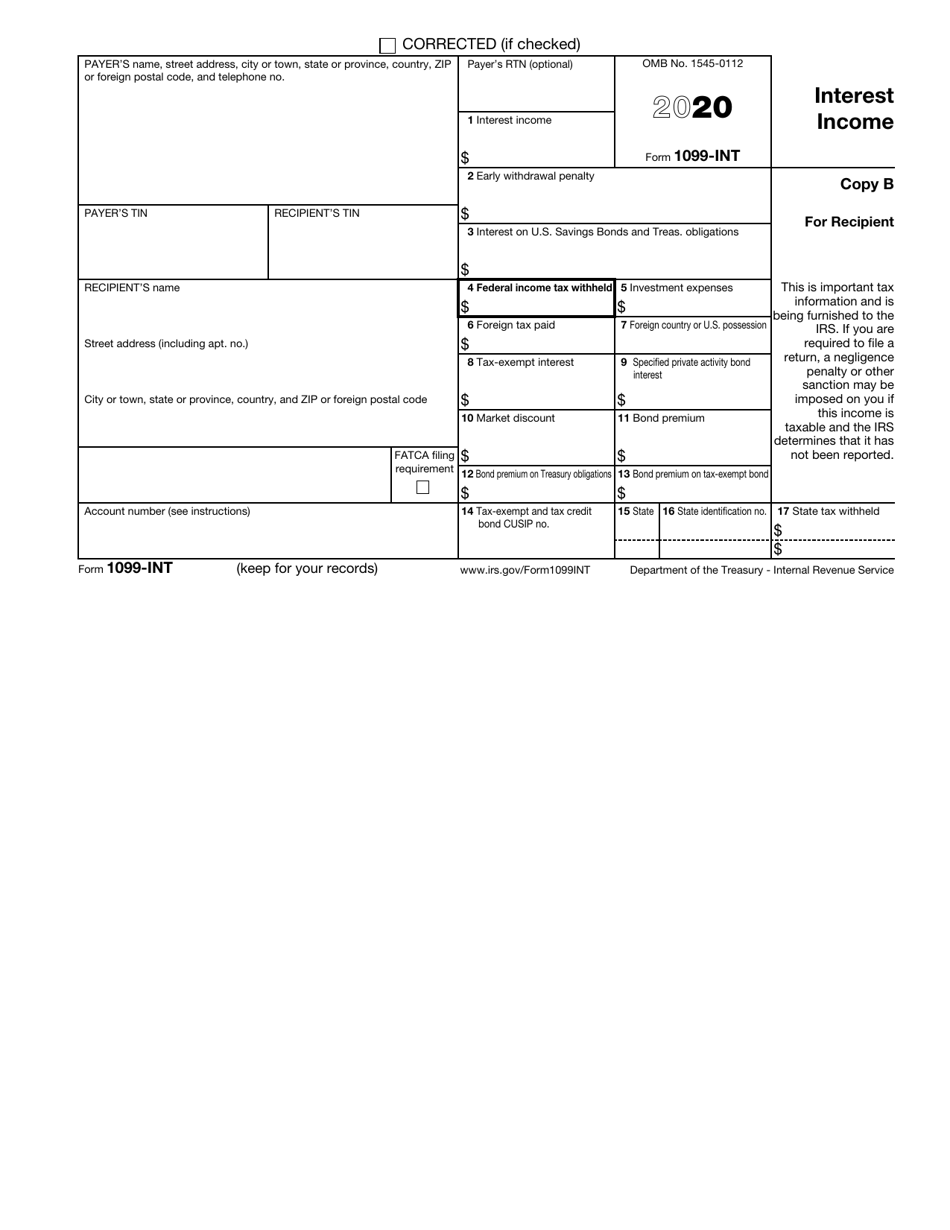

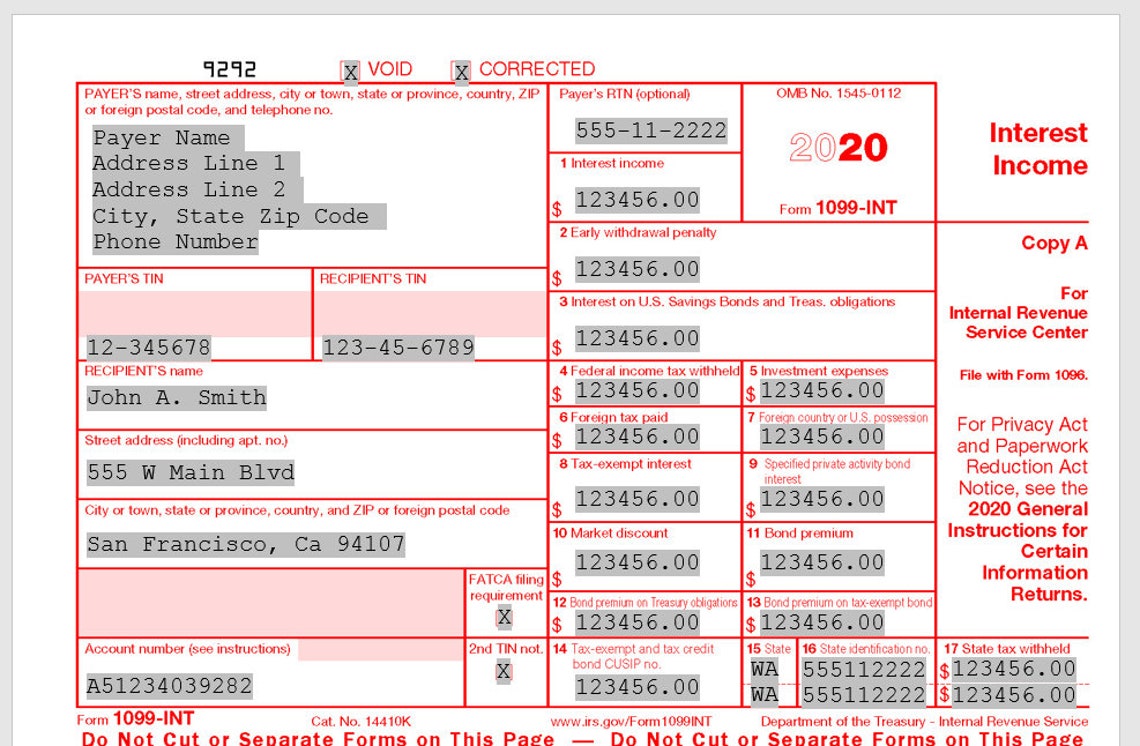

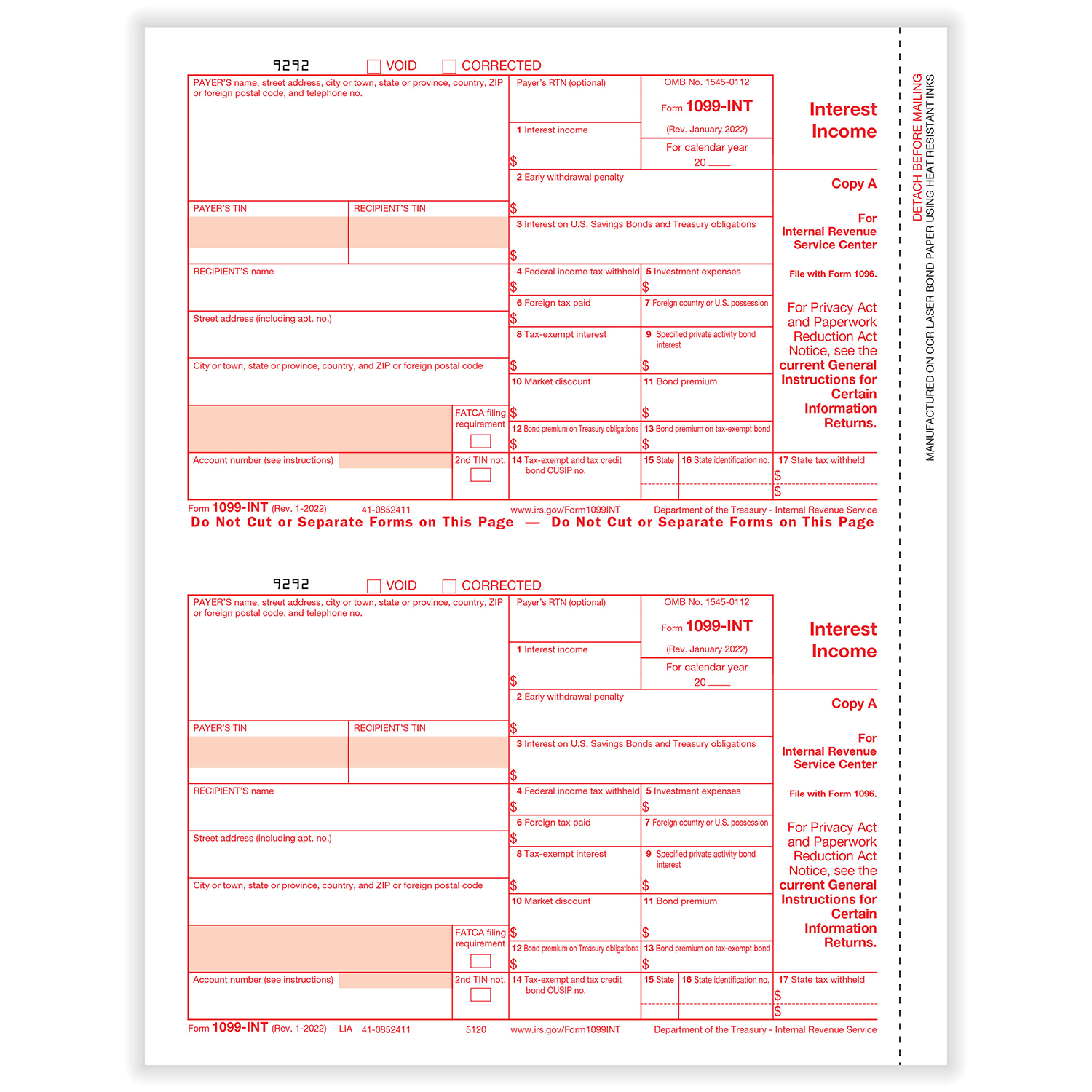

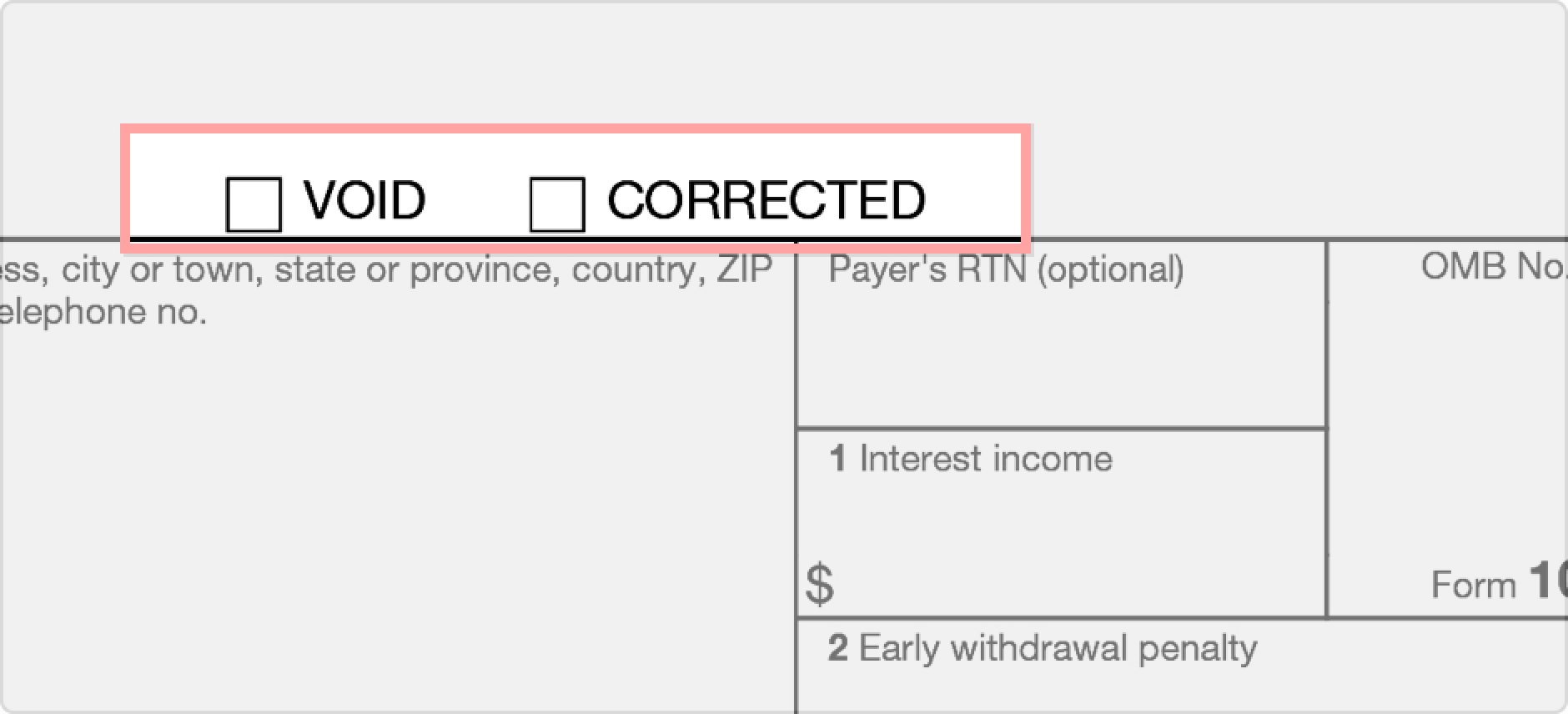

1099 Int Template - To whom you paid amounts reportable in boxes 1, 3, or 8 of at least $10 (or at least $600 of interest paid in the course of your trade or. The form must be filed for any customer who earned at least. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Aimed at taxpayers who have earned $10 or more in interest, this form is a crucial. Ensure your interest income is reported accurately with our guidance. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification. The irs does have a printable. This interest is usually from a bank or government agency. You’ll receive this form if you earn at least $10 in interest during the tax year. Download completed copies of form 1099 series information returns. You’ll receive this form if you earn at least $10 in interest during the tax year. Interest earned needs to be included as part of. This interest is usually from a bank or government agency. Ensure your interest income is reported accurately with our guidance. Download completed copies of form 1099 series information returns. The irs does have a printable. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification. Enter information into the portal or upload a file with a downloadable template in iris. Recipient’s taxpayer identification number (tin). Most interest is taxable and should be. Most interest is taxable and should be. This interest is usually from a bank or government agency. Recipient’s taxpayer identification number (tin). Aimed at taxpayers who have earned $10 or more in interest, this form is a crucial. To whom you paid amounts reportable in boxes 1, 3, or 8 of at least $10 (or at least $600 of interest. The irs does have a printable. This interest is usually from a bank or government agency. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Aimed at taxpayers who have earned $10 or more in interest, this form is a crucial.. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. The irs does have a printable. The form must be filed for any customer who earned at least. Form 1099 int meaning is a tax form the irs provides that allows payers. This interest is usually from a bank or government agency. To whom you paid amounts reportable in boxes 1, 3, or 8 of at least $10 (or at least $600 of interest paid in the course of your trade or. This interest is usually from a bank or government agency. Interest earned needs to be included as part of. Ensure. Aimed at taxpayers who have earned $10 or more in interest, this form is a crucial. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Interest earned needs to be included as part of. Ensure your interest income is reported accurately. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification. Enter information into the portal or upload a file with a downloadable template in iris. Form 1099 int meaning is a tax form the irs provides that allows payers to report interest income of $10 or greater to. Aimed at taxpayers who have earned $10 or more in interest, this form is a crucial. You’ll receive this form if you earn at least $10 in interest during the tax year. Download completed copies of form 1099 series information returns. Form 1099 int meaning is a tax form the irs provides that allows payers to report interest income of. The irs does have a printable. Aimed at taxpayers who have earned $10 or more in interest, this form is a crucial. You’ll receive this form if you earn at least $10 in interest during the tax year. The form must be filed for any customer who earned at least. This interest is usually from a bank or government agency. Recipient’s taxpayer identification number (tin). Aimed at taxpayers who have earned $10 or more in interest, this form is a crucial. Most interest is taxable and should be. Interest earned needs to be included as part of. Form 1099 int meaning is a tax form the irs provides that allows payers to report interest income of $10 or greater to. Download completed copies of form 1099 series information returns. Form 1099 int meaning is a tax form the irs provides that allows payers to report interest income of $10 or greater to individuals or organizations. Recipient’s taxpayer identification number (tin). This interest is usually from a bank or government agency. Interest earned needs to be included as part of. Download completed copies of form 1099 series information returns. The irs does have a printable. Recipient’s taxpayer identification number (tin). Enter information into the portal or upload a file with a downloadable template in iris. Interest earned needs to be included as part of. Interest earned needs to be included as part of. Most interest is taxable and should be. To whom you paid amounts reportable in boxes 1, 3, or 8 of at least $10 (or at least $600 of interest paid in the course of your trade or. Form 1099 int meaning is a tax form the irs provides that allows payers to report interest income of $10 or greater to individuals or organizations. Aimed at taxpayers who have earned $10 or more in interest, this form is a crucial. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. The form must be filed for any customer who earned at least. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification.1099INT Form Fillable, Printable, Downloadable. 2024 Instructions

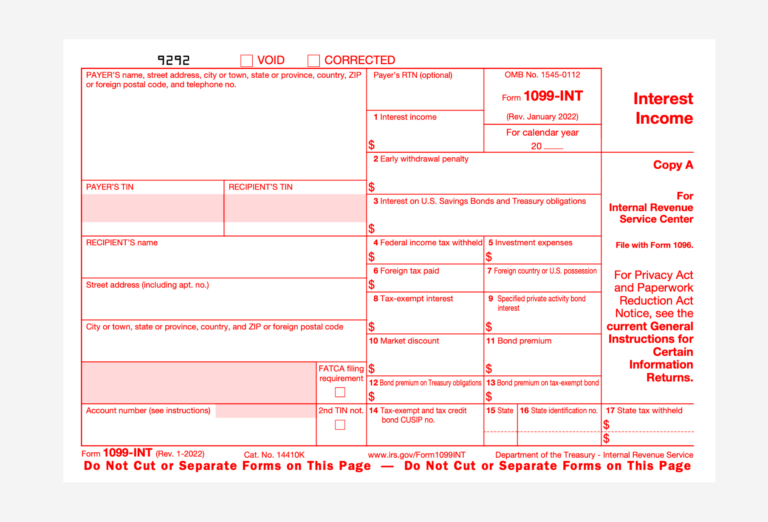

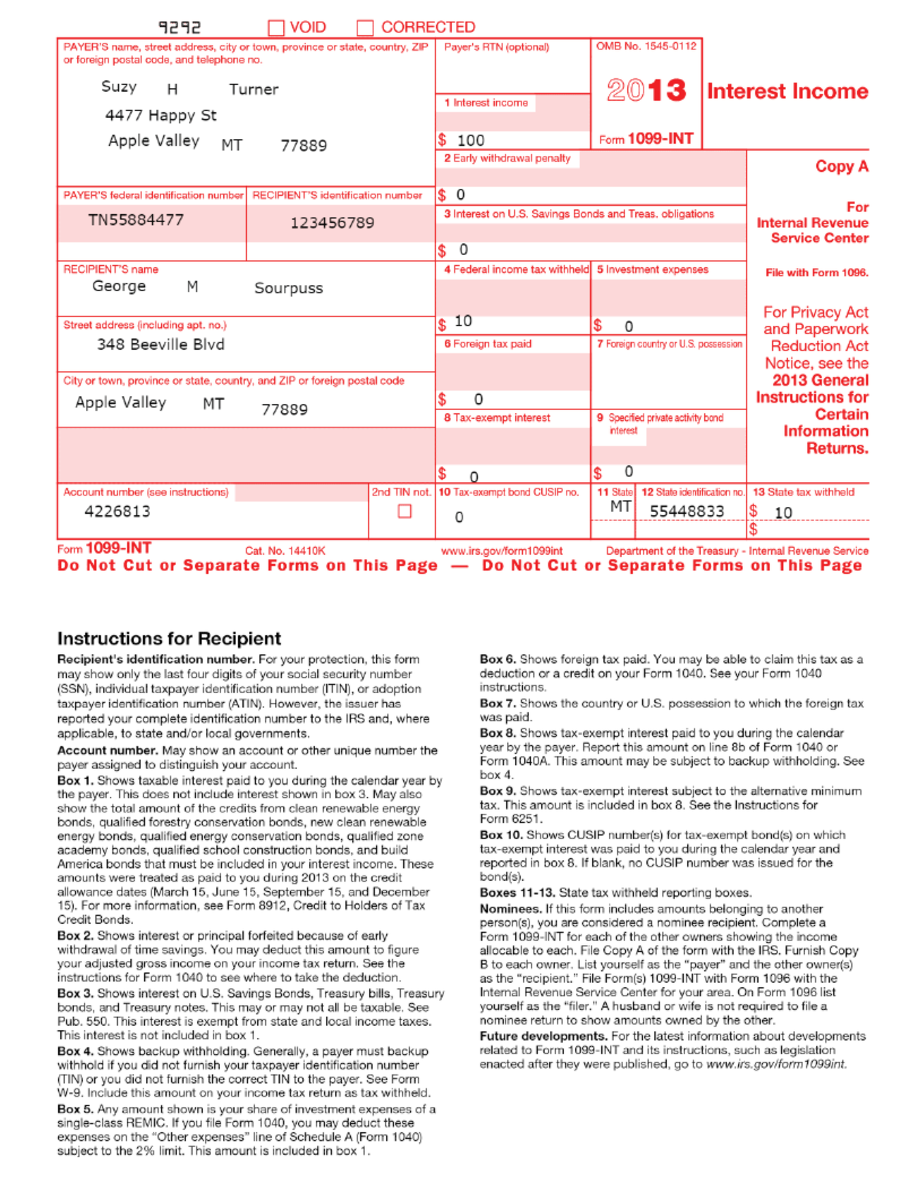

Form 1099 Int Printable Printable Forms Free Online

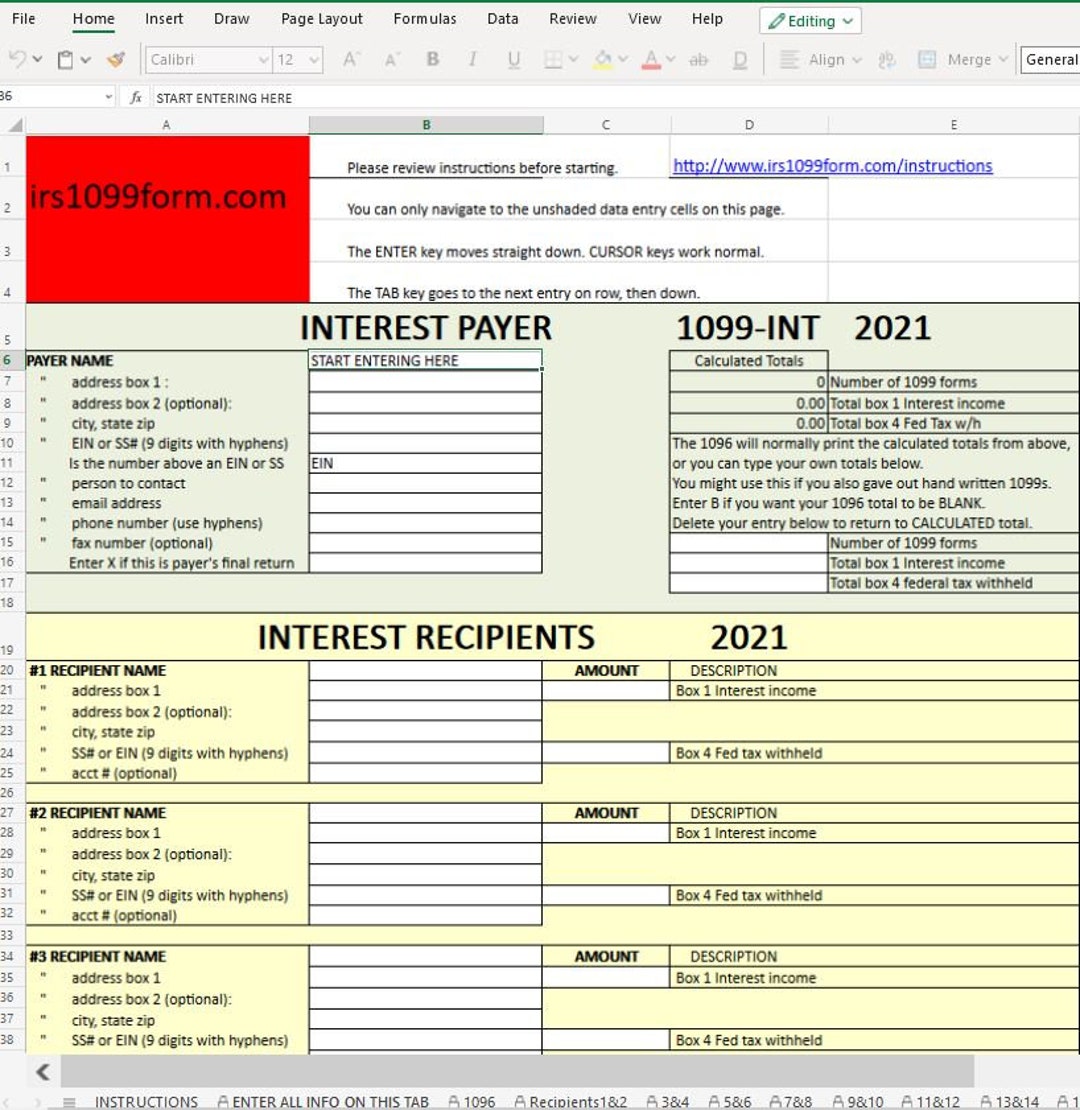

1099INT Interest Excel Template for Printing Onto IRS Form 2022 Taxes

1099INT Form Everything You Need to Know About Reporting Interest

1099Int Template. Create A Free 1099Int Form.

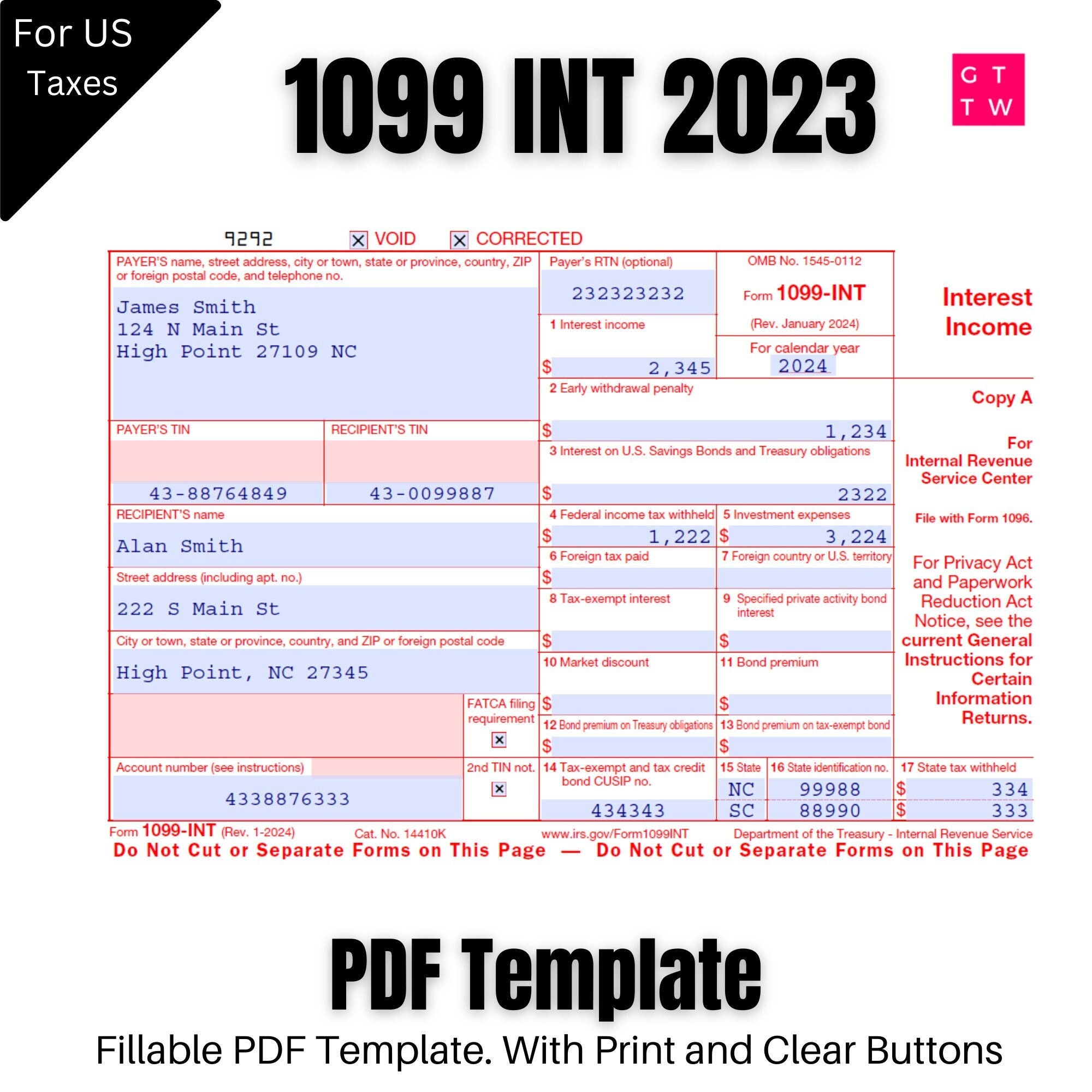

1099 INT Form PDF Template 2024 2023 With Print and Clear Buttons Etsy

IRS Form 1099INT 2020 Fill Out, Sign Online and Download Fillable

1099INT Form Print Template for Word or PDF 1096 Transmittal Summary

1099 Int Federal Form 1099INT Formstax

1099 Int Template

You’ll Receive This Form If You Earn At Least $10 In Interest During The Tax Year.

Ensure Your Interest Income Is Reported Accurately With Our Guidance.

This Interest Is Usually From A Bank Or Government Agency.

This Interest Is Usually From A Bank Or Government Agency.

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png)